Since partnering with BalancedComp, we were able to cut our turnover in half!

Jenni ShortThe Challenge

Turnover was a costly issue for Texans Credit Union, a financial institution managing over $2 billion in assets. Replacement expenses ranged from 50% to 200% of an employee’s salary.

Beyond financial costs, high turnover disrupted operations, reduced productivity, and led to the loss of institutional knowledge. Exit interviews consistently revealed dissatisfaction with pay and benefits as a primary reason employees left.

In addition to turnover costs, the institution faced challenges from quiet quitting, where disengaged employees remained but contributed minimally to organizational goals. Disengaged employees often seek more competitive wages elsewhere, leaving gaps in creativity, innovation, and productivity. The cost of quiet quitting—estimated at up to 18% of an employee’s annual salary due to lost productivity and collaboration—added to operational inefficiencies. This could mean hundreds of thousands of dollars annually in unrealized potential for a mid-sized financial institution.

Furthermore, losing top performers to competitors offering better compensation was particularly damaging. High performers often drive critical projects, innovation, and team morale. Replacing such talent not only carried recruitment and training costs but also risked delaying projects and weakening institutional performance. The combined financial impact of losing top talent and quiet quitting compounded the turnover problem, highlighting the urgent need for a competitive compensation strategy.

The Solution

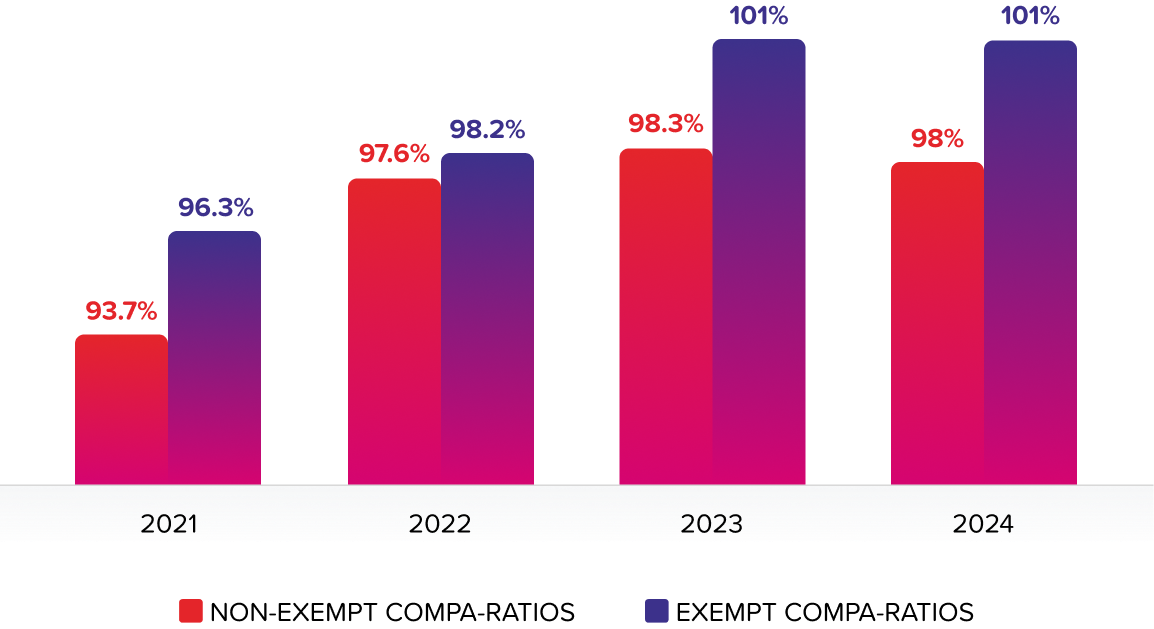

BalancedComp conducted an initial compensation analysis starting in 2021, which showed compensation misalignment was a major factor in turnover. The institution’s compa-ratios—the ratio of an employee’s pay to the market midpoint—highlighted this disparity:

This gap undermined the institution’s ability to attract and retain talent, particularly in key complex roles.

A New Compensation Philosophy

In 2021, the institution launched a comprehensive overhaul of its compensation approach, focusing on three key principles:

- Market Rate Alignment

A commitment to aligning employee pay with market rates (100% compa-ratio) by 2024. - Performance-Based Increases

Pay increases tied to both individual and organizational performance to reward contributions and encourage accountability. - Transparency

Open communication about the new structure and its alignment with organizational goals to build trust and engagement.

Partnering with BalancedComp allowed leadership to implement these changes effectively by refining role evaluations and aligning compensation decisions with organizational objectives.

Engaging Leadership for Change

Leadership played a critical role in the transition by actively participating in reviewing position descriptions and understanding compensation methodologies, thereby gaining a sense of ownership. This approach also established a foundation for sustainable pay practices and ongoing alignment with market conditions. Moving forward, the institution used metrics such as compa-ratio progress, employee engagement scores, and turnover rates to monitor and refine its strategy, ensuring it remained effective.

Performance and Budget Considerations

Individual and organizational performance became critical factors in determining pay increases. BalancedComp’s data and consulting helped leadership structure performance objectives that aligned with the budget, which was paramount for the new philosophy’s sustainability; it ensured that pay increases were performance-based and financially viable.

The Results

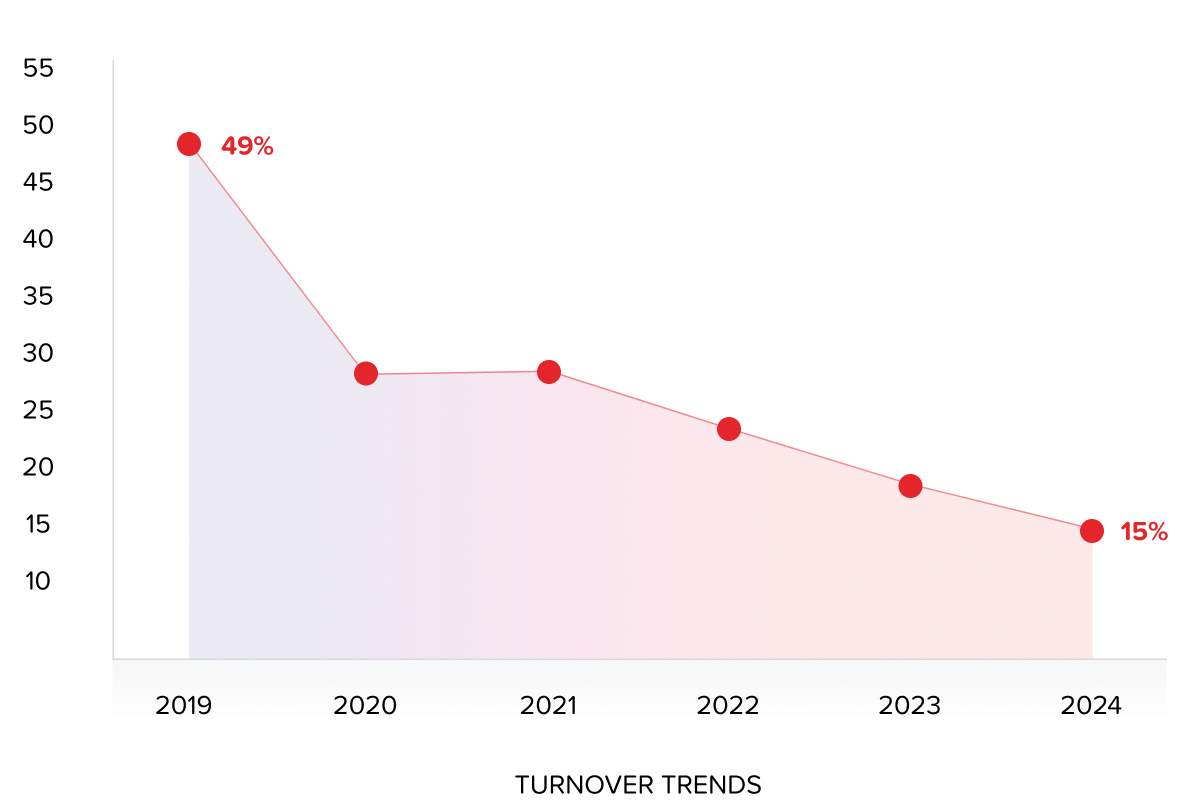

Over the next three years, Texans Credit Union achieved significant market alignment and turnover reduction progress.

This movement toward market alignment clearly reduced turnover, especially in critical roles that were hardest to replace. By 2024, turnover had been cut in half compared to 2021 levels. High retention rates in the exempt (and executive) categories were especially notable, as these positions often involve highly specialized skills that are more expensive and time-consuming to replace.

Broader Benefits and Insights

The revamped compensation strategy brought multiple benefits:

- Lower Costs

Reduced recruitment and training expenses saved hundreds of thousands of dollars annually. - Improved Engagement

Competitive, performance-based pay fostered higher morale and productivity. - Enhanced Service Quality

Engaged employees contributed to better problem-solving and customer satisfaction. - Stronger Talent Pipeline

Competitive compensation attracted top talent.

BalancedComp’s actionable data allowed Texans Credit Union’s leadership to make informed decisions, ensuring that pay adjustments were both equitable and financially sustainable. Employee feedback through surveys and exit interviews reinforced the importance of transparency and fairness.

Building a Culture of Equity and Performance

Texans Credit Union’s success in cutting turnover in half while increasing engagement and operational quantitative metrics underscores the importance of a strategic approach to compensation. By aligning pay with market rates, tying increases to performance, and fostering transparency, the organization improved retention and built a foundation for long-term growth. This strategy, while effective, is just one element of broader organizational change that enabled the team to achieve outstanding results. Continuous refinement of performance objectives and a commitment to equity and engagement remain critical to sustaining these improvements.

The Takeaways

In 2020, a financial institution managing over $2 billion in assets faced above-market employee turnover, causing operational inefficiencies and increased costs. Recruiting, training, and onboarding replacements were especially expensive for hard-to-fill roles in the competitive financial services sector. Employees frequently expressed dissatisfaction with their compensation, which lagged behind market standards, fueling voluntary departures.

Texans Credit Union reexamined its compensation strategy to tackle these issues, focusing on aligning base pay with market rates and refining performance objectives. Their leadership team strategically partnered with BalancedComp to ensure equitable pay structures across the organization. This collaboration involved educating leaders about role evaluations and market data, fostering buy-in and engagement for the change process.

By 2024, the institution’s compa-ratios improved significantly, with exempt staff reaching 101% of the market rate. Turnover dropped from 49% in 2019 to 15% in 2024. The new strategy reduced costs, increased employee engagement, and attracted top talent, contributing to better operational performance and a strong foundation for future growth.