By Christie Summervill

Win Hearts. Protect Payroll. Stay in Control. Human Resources is continually steering a ship through choppy water. There is a tight labor market, inflation is nibbling at margins, and more economic fog is expected on the horizon. And now, it includes a salary increase budget flatlining at 3.9% – slightly lower than last year.

There are still plenty of employees with pay levels beneath the market rate, even though they have enough experience and are good performers. Here’s the next question for HR: How do you make 3.9% feel like 10% to your employees, without breaking the bank or your credibility with the executive team?

The Big Picture

According to WorldatWork, 60% of organizations made mid-course corrections to salary budgets last year. Those who did not may need a bigger budget than the average in 2026. But now, 31% are scaling back for 2026, spooked by recession chatter or needing to trim fat. Meanwhile, others are ramping up pay in response to a brutal labor market with low unemployment despite a reduced inflation rate.

The message? Surface-level stability, but chaos underneath. Just like a tense negotiation, you’d better understand what’s really driving the other side.

Brittany Innes, Product Director of Rewards Data Intelligence at Willis Towers Watson, nailed it when she said: “The real shift is happening beneath the surface.” Translation? Precision matters. This isn’t about throwing cash at problems—it’s about targeted investment and deliberate action.

Stability Doesn’t Equal Satisfaction

Turnover is cooling. Financial institutions are reporting turnover, close to 23% in 2022, and now averaging closer to its historical average of 20%. The 2024 Hppy report notes that millennial turnover in financial services is particularly high, with only 10% of millennials planning to stay in their roles long-term, and 42% open to new opportunities. This suggests that while overall turnover rates are stabilizing, specific demographics and roles continue to drive concern.

But don’t confuse retention with engagement. While people aren’t running, they’re not exactly running toward you either. Disengagement is stealthy. So ask yourself: Are your employees staying because they want to or because it’s just not worth the hassle to leave?

Here’s what winning teams are doing:

- 47% are leveling up the employee experience (flexibility, connection, culture)

- 43% are doubling down on health & wellness

- 40% are investing again in training after cutting back last year

Because a comp plan without development is like giving someone a raise and asking them not to spend it. (That’s the joke. You can laugh—HR is allowed to be funny.)

Precision Beats Popularity

You can’t please everyone – and you shouldn’t try. Here’s what high-impact financial institutions are doing:

- 50% are auditing compensation to ensure fairness. (Pro tip: Use a third-party to keep it real.)

- 48% are focusing on key talent—those you can’t afford to lose

- 45% are hiring above the midpoint

- 40% are increasing starting salaries to stay in the game

- 43% are using spot bonuses to recognize loyalty when it counts

- 37% are giving targeted base salary bumps where it matters most

Meanwhile, payroll costs are up 3.6%. This isn’t just inflation—it’s a wake-up call to allocate smarter from the start.

Tactical Playbook: 2026

You don’t need a miracle. You need a plan. Here’s your four-move strategy:

1. Listen Before You Offer

What are your people really asking for—flexibility, meaning, growth? Don’t guess. Run that engagement survey. It’s your recon.

2. Invest Beyond the Paycheck

Career development and wellness aren’t fluff—they’re your leverage in building loyalty.

3. Be Surgical with Increases

Don’t try to spread a 3.5% blanket across the entire org evenly. Focus on high performers, mission-critical roles, and those who are paid below the market – these are often your first-year employees. A 2023 study by the Society for Human Resource Management (SHRM) found that approximately 20-25% of new hires leave within their first year, with the highest churn happening around the 90-day mark. New employees are often paid low in the range and may never get a pay level closer to the midpoint if salary ranges match the market movement.

4. Stay Nimble

Conditions can turn fast. Prep your leadership for the need to pivot if salary levels need to adjust, especially for critical jobs or those with the fastest-moving salaries. Agile organizations win.

Bottom Line: You’re not just running HR. You’re negotiating the future of your organization. Use this data to control the narrative, the budget, and the culture.

This isn’t about holding the line. It’s about winning trust, sustaining engagement, and getting the most from every dollar—because 2026 isn’t going to wait for you to catch up.

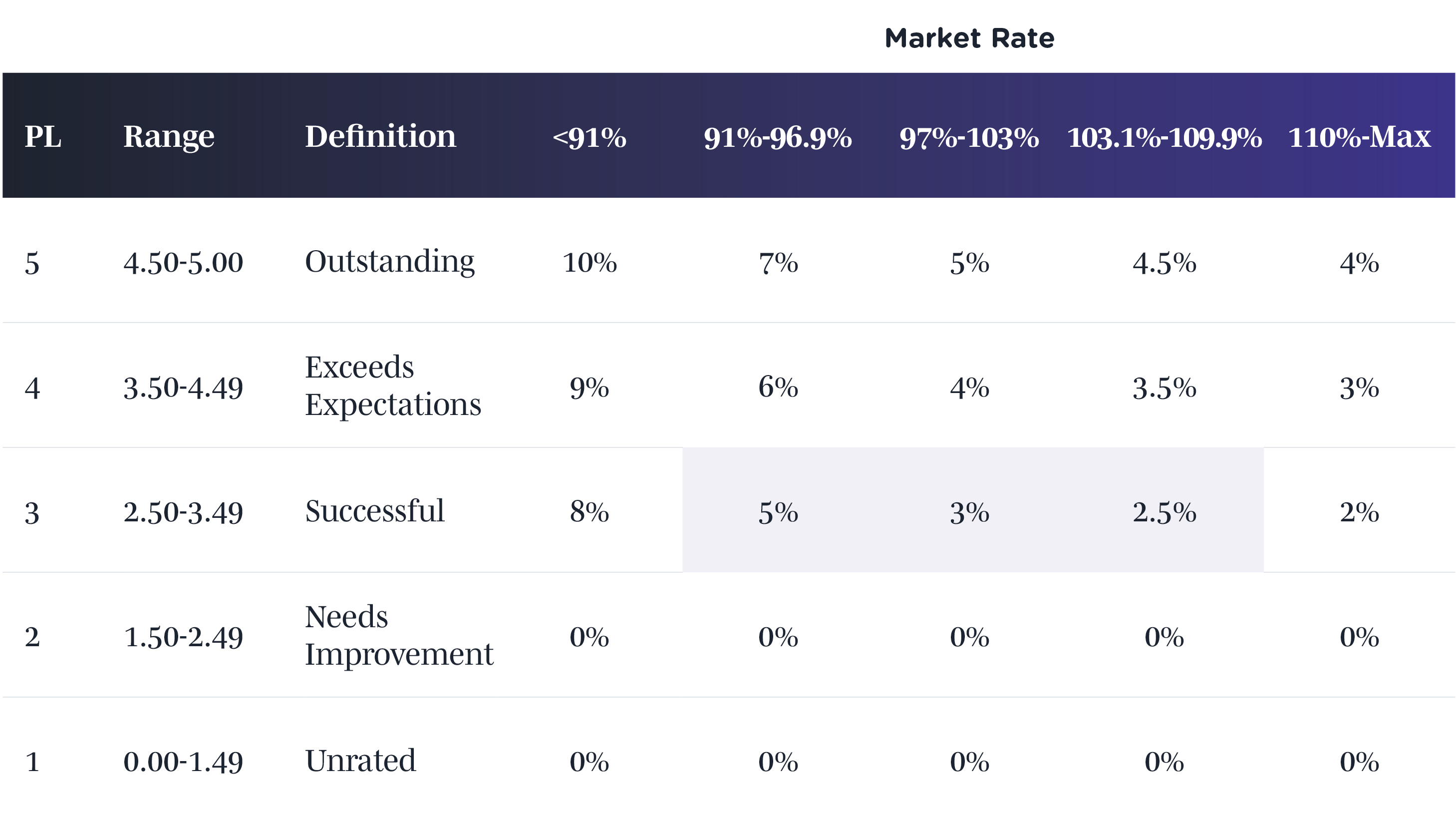

Below is the recommended 2026 Merit Increase matrix for Non-exempt, designed to move pay levels to the midpoint in 3 years:

*Subject to change

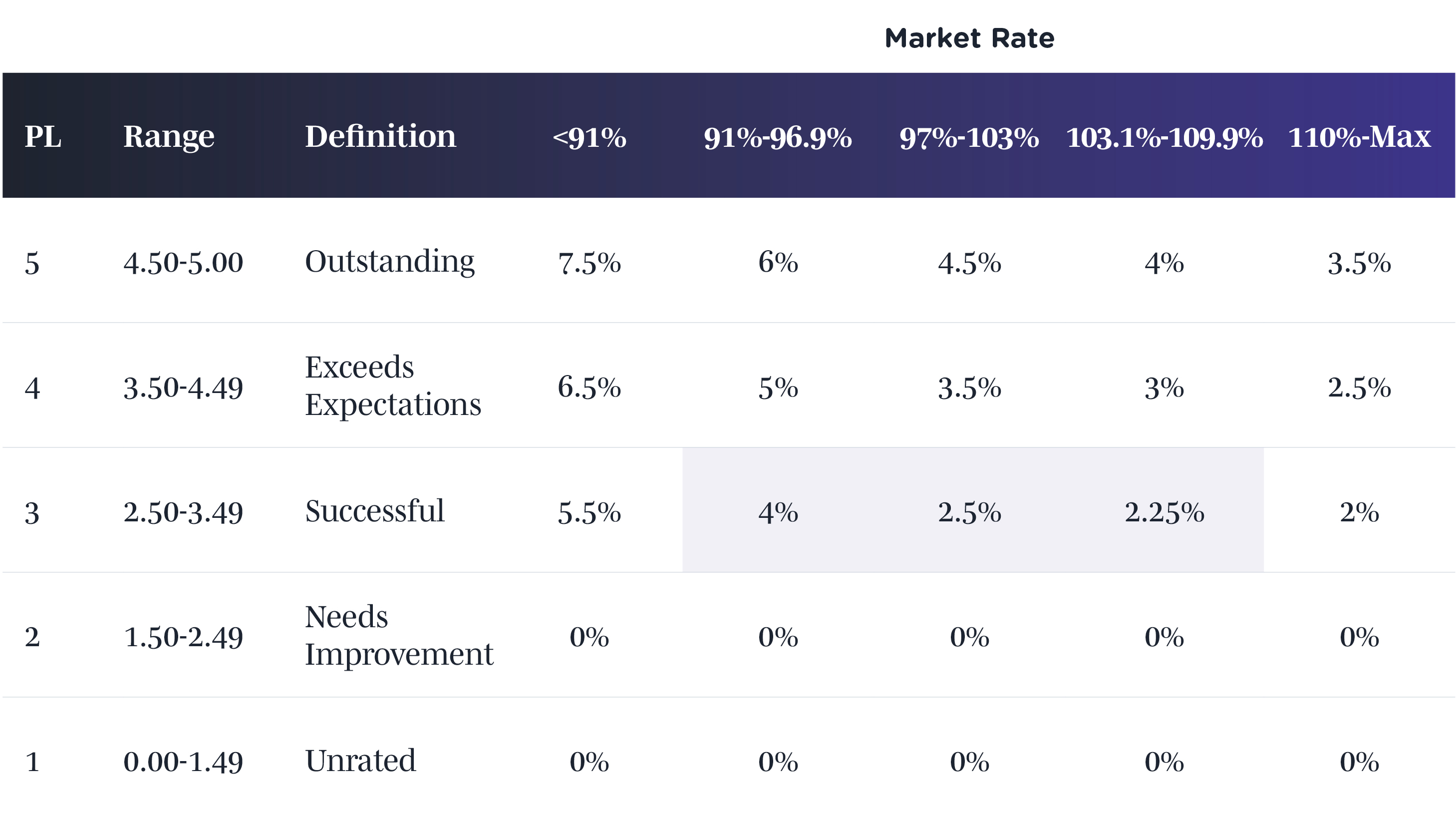

Below is the recommended 2026 Merit Increase matrix for Exempt, designed to move them to the midpoint in 5 years:

* Subject to change

These will not be appropriate for those in jobs with faster-moving salaries. Your move. Let’s make compensation your sharpest tool—not your softest expense.

If the projected labor budget of 3.75% – 3.9% is less than last year, since this matrix matches what it was in 2025, it is likely that employers will either not reward for performance to the same degree, not move employees to midpoint as quickly as they should, or choose to have a labor budget slightly higher than the average in the market.

Back to Blog