By Christie Summervill

BalancedComp is pleased to publish the results of the 2019–2020 Lending Compensation Survey.

The data points are from 175 incumbents in the Mortgage Loan Officer/Originator (MLO) role and 123 in the Commercial Loan Officer (CLO) role. Ours is the only lending survey in the country that shows how many tiers institutions use to determine commission structures as well as the performance criteria on incentive plans for MLOs and CLOs.

The 2019–2020 survey contains a few surprises. For one, total cash compensation for Mortgage Loan Officers/Originators has not changed significantly since our 2016 MLO survey. Another surprise is that nearly 50% of the respondents did not report a change in the commission structure for MLOs with higher levels of production. Perhaps this functions to dissuade employees from holding onto sales to ensure a more profitable next quarter. Of organizations that do have tiers, the average number was slightly less than three. More than half of the MLOs participated in the company bonus structure and also received personal commissions. Our anecdotal observation is that the opportunity to participate in both variable pay opportunities is trending downward.

Mortgage loan officers typically work in one of two types of shops. One pays a market-based base salary and offers a lower incentive. Of those, 65% reported paying less than 24 basis points on commission. The other pays all commission with a forgivable draw or very low salary. Their typical commission was 35–50 basis points.

Remember that employees who are successful under each structure will have different profiles. An employee who performs well with a market-based salary with a lower commission is generally not a high risk-taker. Changing their pay structure to low base/high commission will engender low morale and may lead to turnover.

Some have said they’re throwing out much of their 2020 strategic plan.

Fifty percent of mortgage loan sales managers receive incentives based on their reporting MLO production, and nearly 78% still participated in the company-wide bonus program. More than 45% are also paid a commission on their own individual production. One wonders if this practice leads to competition with their own staff. Only 22.73% of mortgage loan sales managers do not produce originations themselves.

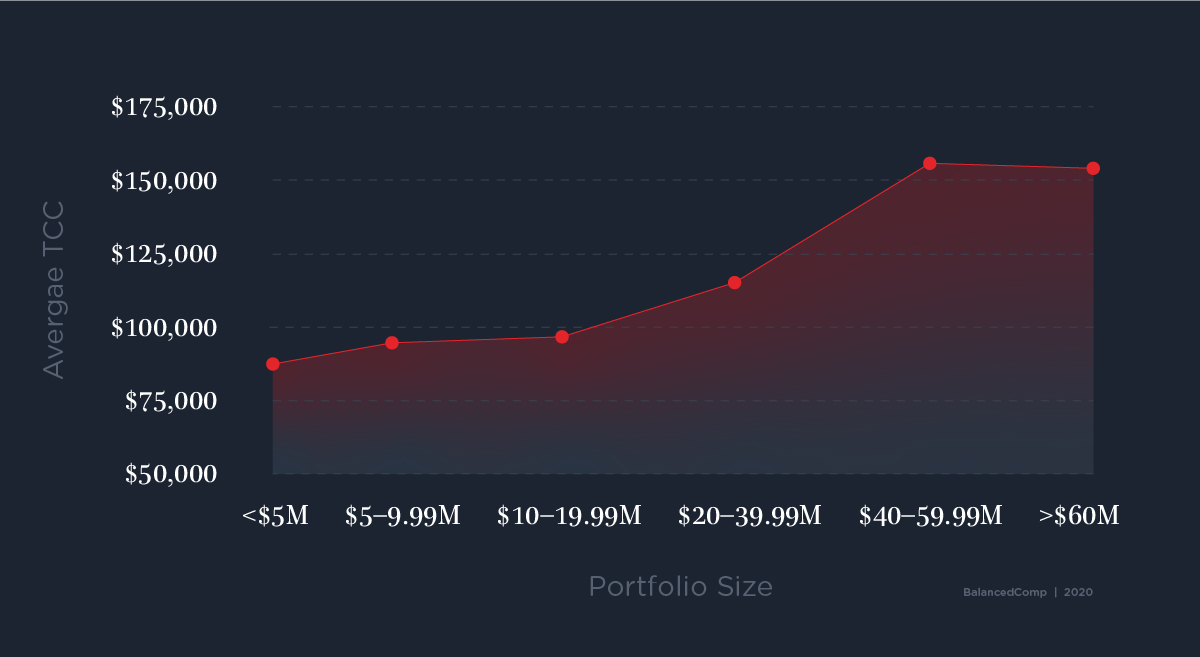

The biggest surprise in the data about commercial loan officers is their average tenure. Regardless of portfolio size, they average between 10–20 years with their institution — this seems to be a profession people stick with. The survey demonstrates there are typically four levels of commercial lenders, and levels are based on portfolio size. Junior commercial lenders typically hold portfolios under $5M. This role may be held by a longstanding employee, as the salary grade is based on the production and its impact to the bottom line rather than employee experience. The portfolio levels rise from there: A CLO I has a portfolio of $10M–$20M, a CLO II has a portfolio of $20M–$40M, and a CLO III has a portfolio of above $40M. Surprisingly, the average total cash compensation between those who held a portfolio of $40M–$59.9M and those with a portfolio greater than $60M did not vary significantly.

Once again, another survey fails to show evidence of CLOs receiving large amounts of incentive pay. However, that may be indicative of the asset size of our participants, which capped at $4B. It is clear that commissions and incentives are paid out annually 75% of the time.

The top five factors impacting CLO incentive plans are:

- Individual loan volume

- Individual portfolio growth

- Individual fee income

- Individual deposit growth

- A tie between cross-sells, individual portfolio credit quality, and departmental portfolio growth

Consumer financial priorities have dramatically shifted this year, and institutions are experiencing a slowing of loan demand and an influx of deposits. It may be time to reset both your annual goals and the incentive plans that go with them. “This economic crisis presents an opportunity to make midyear alterations to goals and incentives that you usually wouldn’t want to do during ‘normal’ times,” says Paul Robert of FI Strategies. Many of our clients tell us that some of their scorecard KPIs will suffer greatly, particularly income, loan growth, loan yield, and membership growth. Some have said they’re throwing out much of their 2020 strategic plan. Incentive programs that are linked to these goals and plans at a corporate, group, and individual level will likely see a significant impact as well.

It is possible that once the recession is in full force and mortgage rates rise, employees may be unlikely to hit their goals through no fault of their own. During these times, those who are used to the rewards of taking a risk and living on high commissions may find themselves not able to meet their financial obligations. While one could sing, “That’s how it goes — everybody knows,” it won’t be beneficial to lose talented salespeople.

This survey evolved from our clients, who asked us for more data. We hope to provide it annually. It will be interesting to see how next year’s survey results differ due to our current economic tide.

Back to Blog