By Jordan Summervill

From Cooling to Stability: How the Labor Market is Evolving into 2025

The U.S. labor market has evolved significantly between Q2 2024 and Q2 2025. While 2024 showed signs of cooling after the Great Resignation, 2025 is demonstrating a more stabilized environment where employer influence is rising, and employee mobility is shifting. This report blends narrative and data to help you understand the most meaningful changes over the past year.

In 2024, the labor market was cooling yet remained above average strength, with continued momentum from The Great Resignation era. By 2025, the “Big Stay” is in full effect but showing signs of softening, particularly among younger generations. Employer bargaining power has grown, contributing to fewer job openings, more selective hiring, and moderate wage increases.

As we step further into 2025, the labor market has entered a new chapter—one that signals more than just a cooldown from the frenzied hiring of recent years. We are now seeing a shift toward a more stable, more selective, and more employer-balanced environment. But to truly understand where we are today, it’s worth revisiting where we stood just one year ago.

In early 2024, much of the workforce was still adjusting to the aftermath of the Great Resignation. Unemployment was low at 3.9%, interest rates held steady at 5.5%, and inflation was cooling from 2022’s peaks, averaging 4% through 2023. Wage growth was still high, typically ranging from 4% to 5%, with job switchers often securing substantial salary increases. It remained a largely employee-driven market, competitive, flexible, and rapidly evolving.

Employers, particularly in the banking and credit union sectors, were actively recruiting and retaining talent through flexible work schedules, expanded compensation packages, and even out-of-cycle raises. The BalancedComp Survey reported that in 2022 & 2023, 73% of participants had provided out-of-cycle raises to certain employees and/or positions. For many, 2023 was about adapting to high turnover and ensuring they remained attractive in a candidate-driven environment. Workers felt empowered to negotiate for better terms or to leave and find more meaningful work elsewhere.

By mid-2023, the era of the Great Resignation was widely considered to be over. This mass reshuffling allowed employees to prioritize their values, whether that meant better pay, more flexible work, or stronger alignment with organizational culture. The result was a wave of talent finding better fits and staying put. This marked the beginning of what we now refer to as the “Big Stay.”

National Turnover Across the U.S.

In early 2023, the quit rate was 2.4% across sectors and 1.5% in the Financial Activities industry. Last year, the national quit rate was down to 2.1% across sectors and 1.3% in the Financial Activities industry. In Q2 of 2025, the quit rate is now down to 2.0% and 1.2% in the Financial Activities industry.

Annual turnover typically averages 20%. However, the 2024-2025 BalancedComp Salary & Incentive Survey reported 16.50% turnover in 2023 from 174 financial institutions.

So, Where Are We Now?

In the second quarter of 2025, the “Big Stay” is still holding, but cracks are beginning to form. Younger generations like Gen Z and Millennials, who value purpose, learning, and flexibility, are showing early signs of mobility once again. While overall quit rates have declined slightly, the desire for growth and change is likely simmering just below the surface.

There’s also a clear shift in employer behavior. Job openings have dropped from 8.8 million in late 2023 to roughly 7.6 million now—a decline, but still well above pre-pandemic levels. However, most organizations are no longer creating new roles at the same pace. Growth hiring has slowed, and companies are being highly selective, hiring only when the fit is strategic, skill-specific, or productivity-driven.

This is especially true in the Financial Activities industry, where 2022 marked record-high job openings. While 2023 saw an 18% drop in hires from the previous year and a further 2% drop in 2024, the current hiring pace is now just slightly above the 10-year average. In the 2023–2024 BalancedComp Survey, 46.5% of participating banks and credit unions reported plans to maintain current staffing levels—an approach that has remained consistent in the 2024-2025 Survey at 48.6%. However, 22% of banks and credit unions are still working on increasing their headcount, with an additional 20% of them increasing in certain departments. In 2025, while hiring has cooled, it has remained steady above pre-pandemic norms, primarily looking for strategic and skill-based roles with a focus on backfilling and internal development.

While job openings are decreasing and the Consumer Price Index has cooled off to 2.4% as of March 2025, unemployment has ticked up slightly to 4.2% nationally and between 2.0-2.8% in the Financial Activities sector. Job creation is slowing, but productivity remains strong, offering some buffer for wage stability. Inflation, now between 2.4% and 3.0%, has gradually declined over the last two years, allowing the Federal Reserve to slightly lower rates to 4.25%-4.50% in December 2024.

Wage Growth & Retention: A New Balancing Act

Wage growth is showing signs of cooling in 2025. In the last few years, salary increases have been around 4-5%, whereas 2025 is showing closer to 3.5%-4%. The Federal Reserve’s Beige Book in February 2025 reported that wage increases have been modest-to-moderate, slightly lower than the previous year. Job switchers are no longer guaranteed the substantial raises they once were, and employers are taking a more conservative approach, rewarding employees based on performance, capability expansion, and productivity.

Still, many companies remain cautious. While the Beige Book reports that new hires are receiving moderate wage increases, it also notes employers are now more selective and are quickly replacing underperforming staff. At the same time, the risk of losing talent remains. Organizations that pull back too aggressively on flexibility or rewards, especially in hybrid work arrangements, may see a rise in quiet quitting, disengagement, or outright turnover. While hybrid work arrangements have been common in the past few years, they’re largely considered to be standard in 2025, with companies scaling back on remote roles for new hires.

Generational Forces & What’s Next

Gen Z and Millennials are poised to reshape the next phase of the labor market. As their careers gain momentum, they are more likely to seek meaningful, purpose-driven work. Their comfort with technology, adaptability, and hunger for advancement mean that while they’ve been part of the “Big Stay,” they’re also likely to lead the next wave of movement, especially as opportunities emerge in areas like fintech, AI, and finance.

Final Thoughts

We are now in a distinctly different labor market than we were a year ago. What started as a cooling trend in 2023 has matured into a more balanced, steady environment in 2025. Employers have regained some leverage, but the smartest organizations know that today’s stability doesn’t mean complacency. A new wave of generational movement is on the horizon, and those who continue to invest in purpose, flexibility, and growth opportunities will be best positioned to attract and retain top talent.

The labor market may no longer be as fiery as it was during the Great Resignation, but it’s far from static. The key going forward will be adaptability, on both sides of the hiring table.

The period from 2024 to 2025 illustrates a labor market that is stabilizing but no longer red-hot. Job openings, wage growth, and turnover are moderating, while productivity and strategic hiring remain central to employer planning. The “Big Stay” is still present but may be loosening, particularly among younger workers with higher mobility and expectations.

Employers in banking and finance should remain data-driven, balancing conservatism in staffing with the need to retain and develop key talent. As labor dynamics continue to evolve, understanding year-over-year trends is critical to staying competitive.

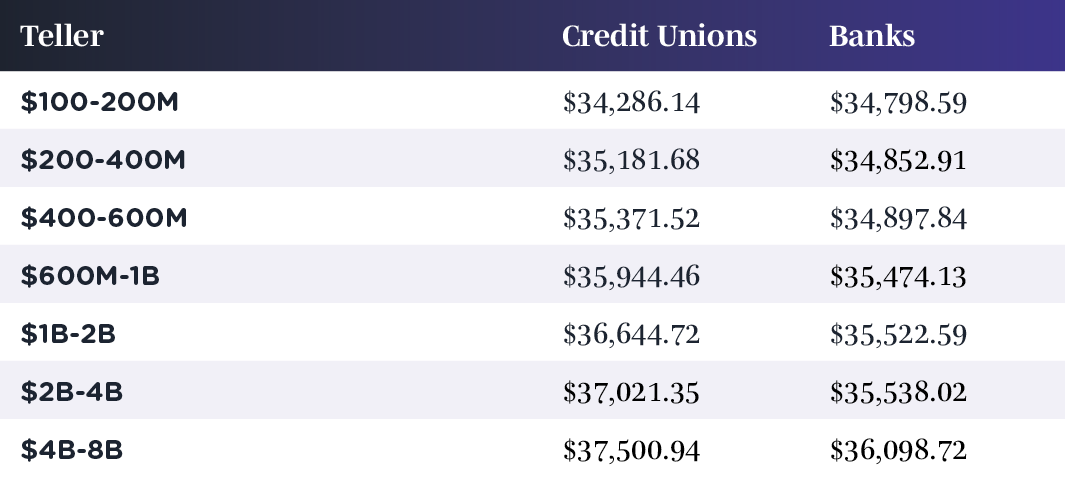

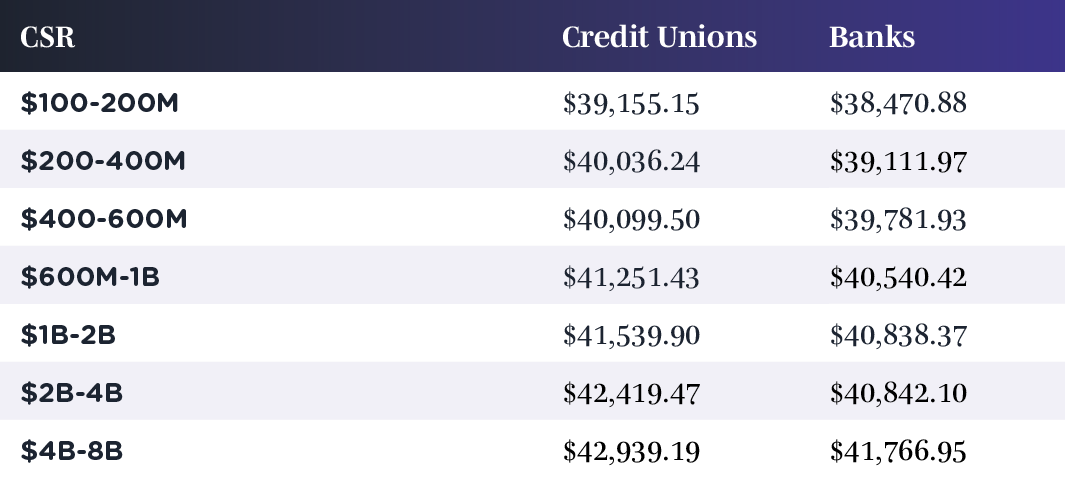

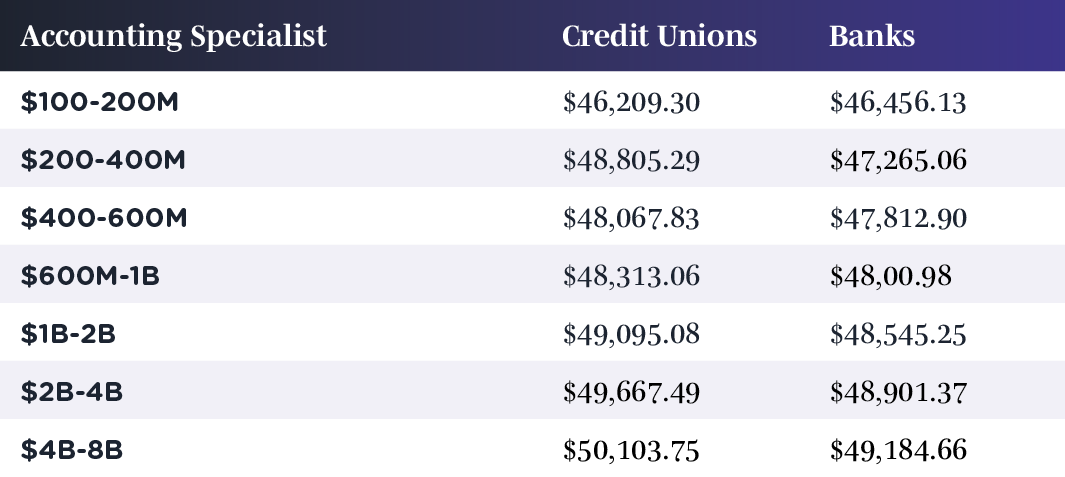

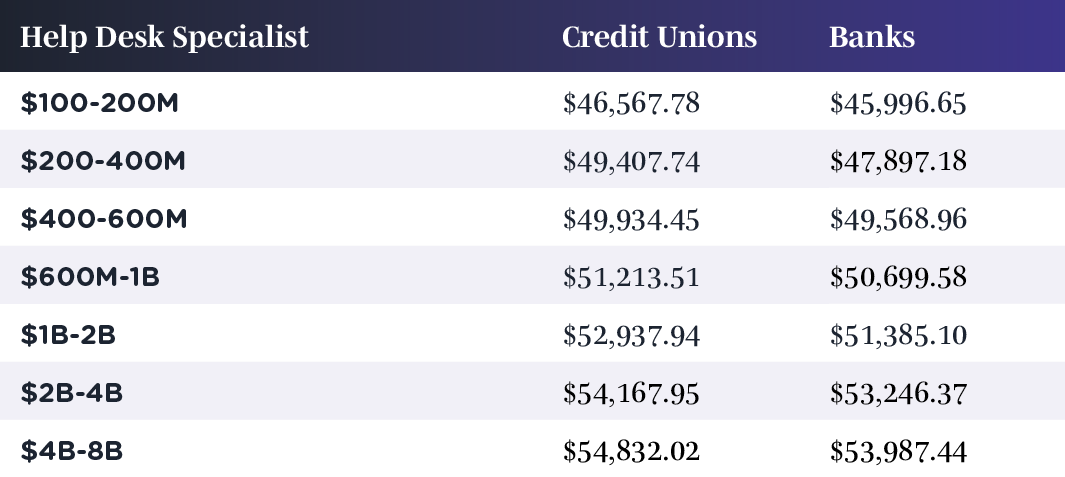

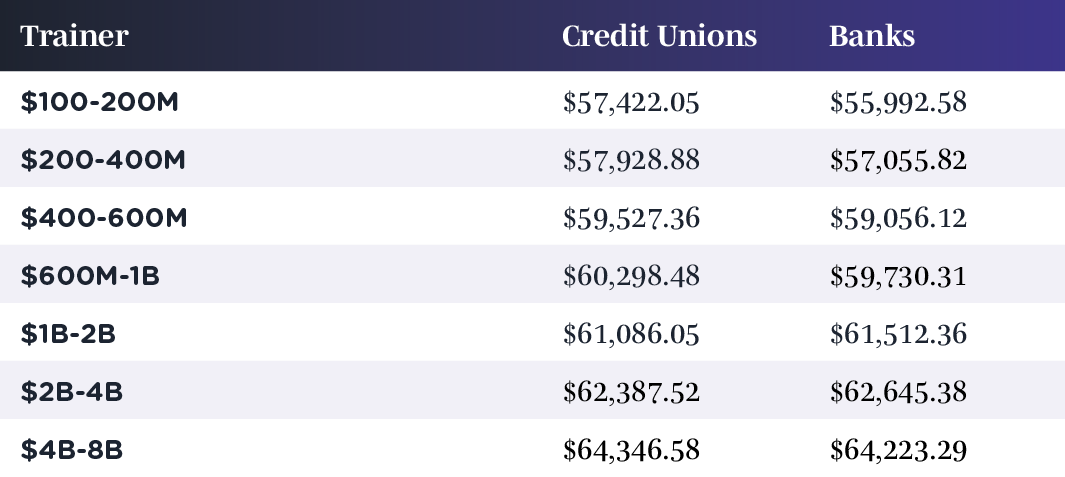

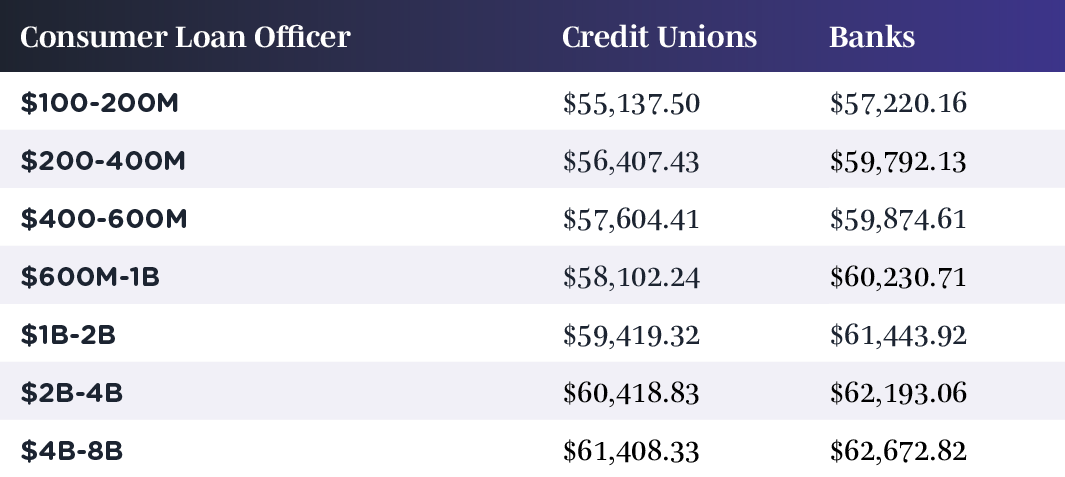

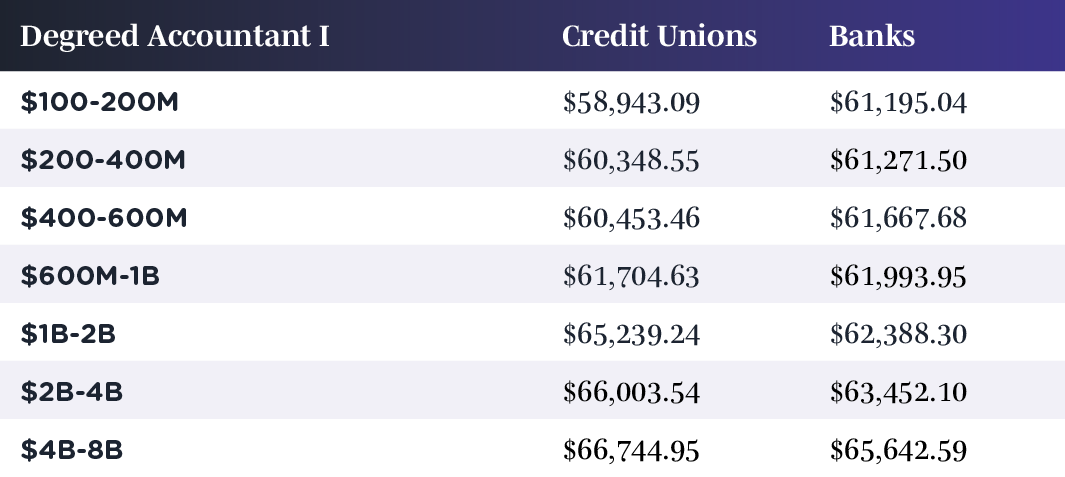

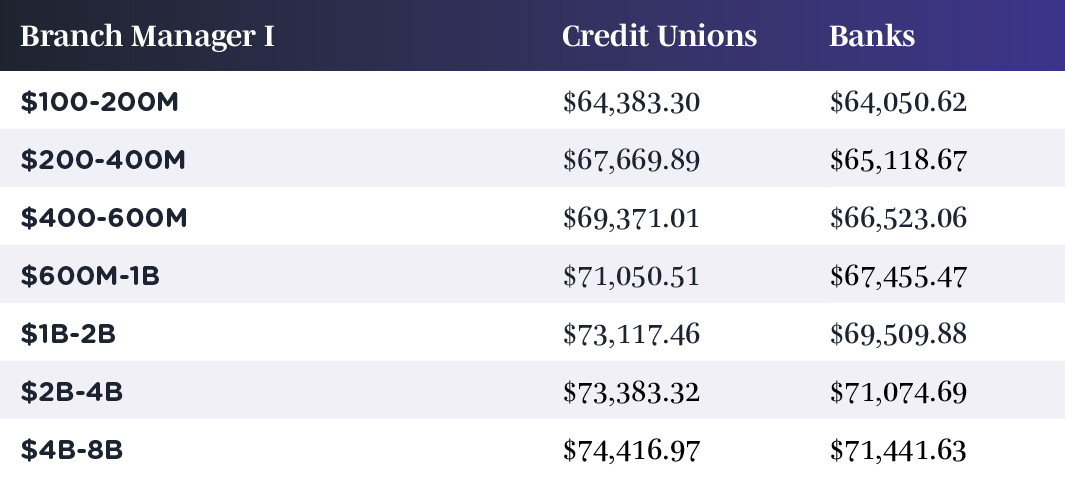

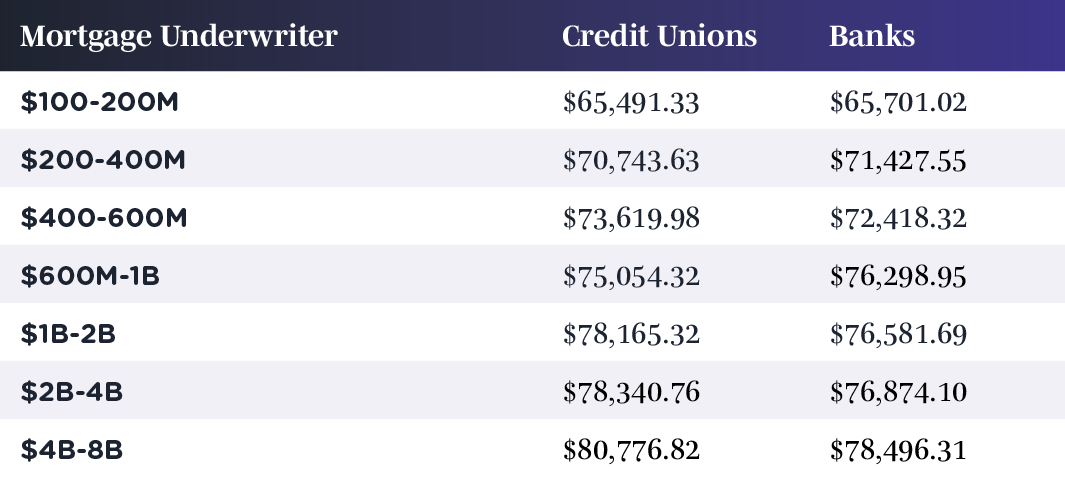

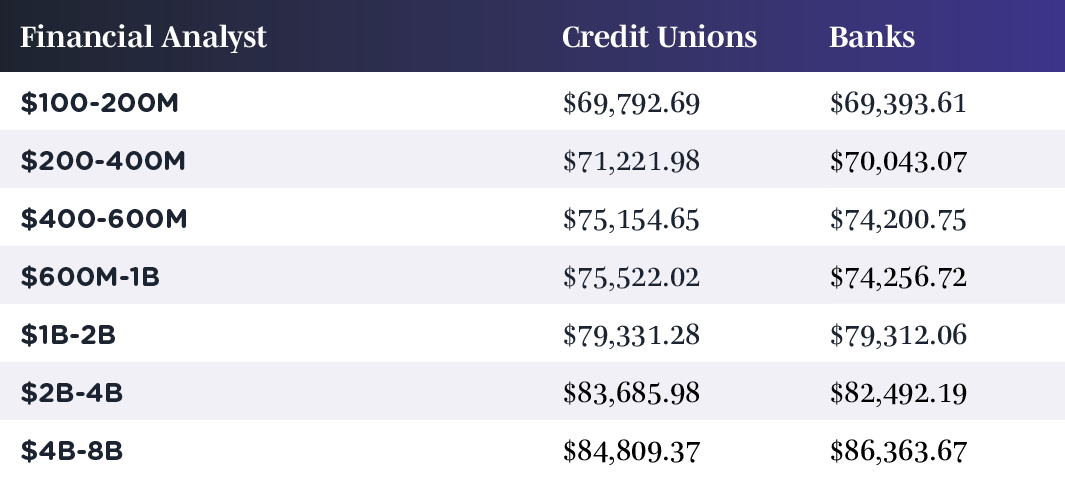

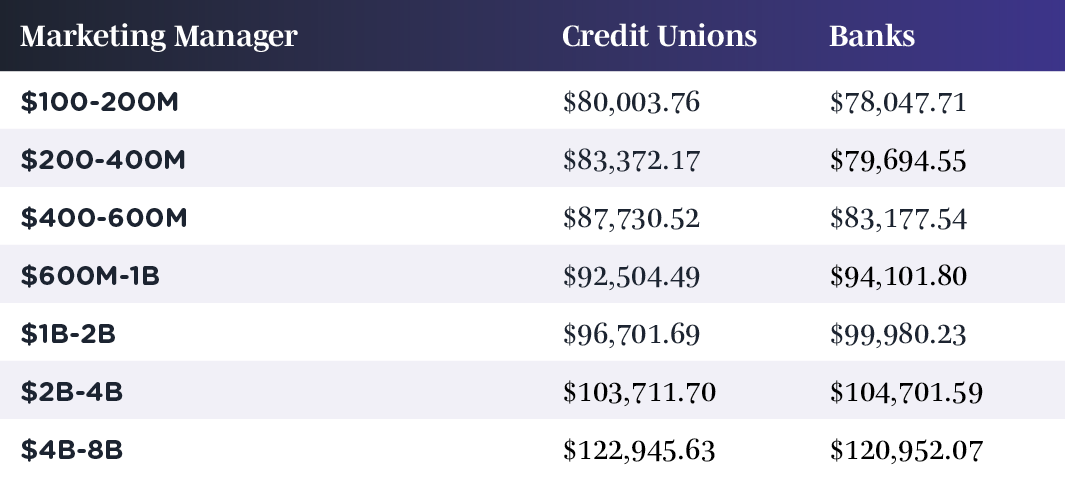

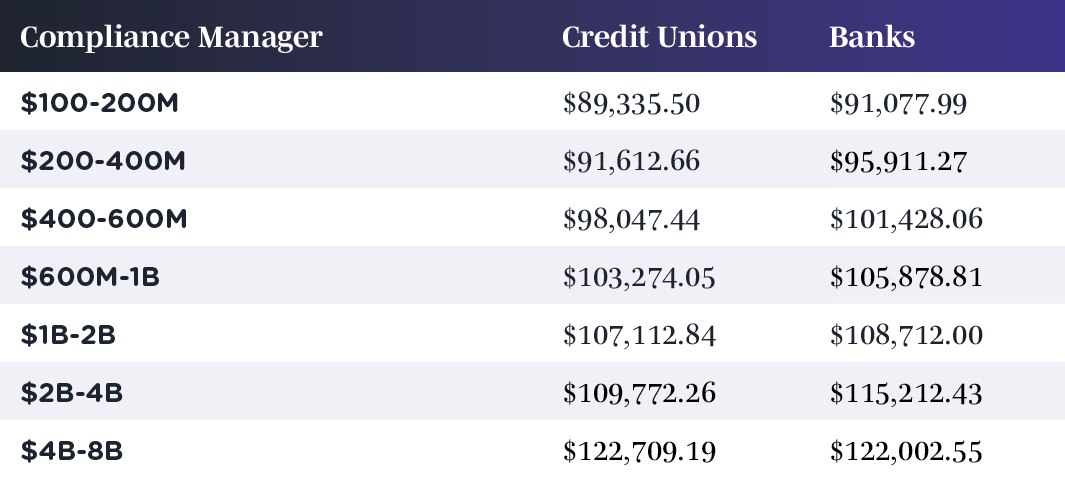

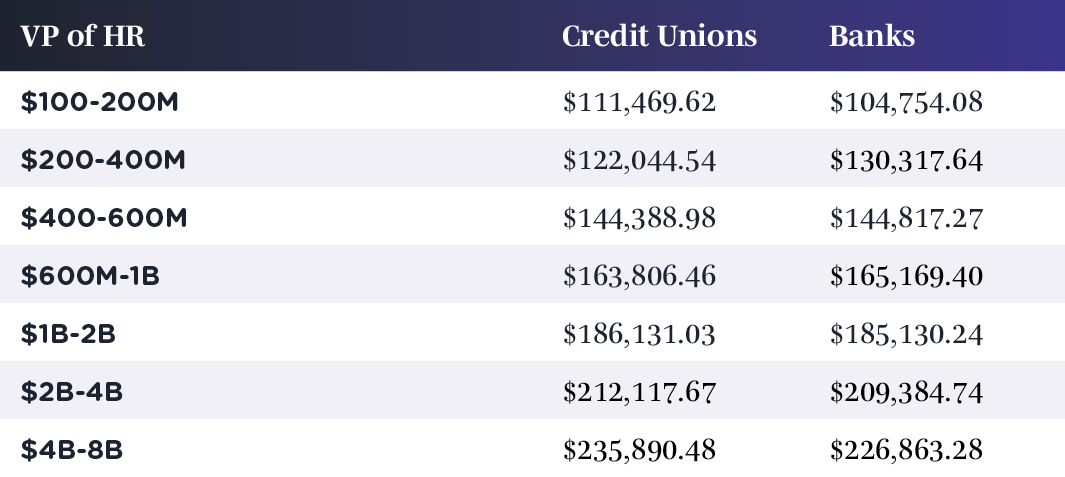

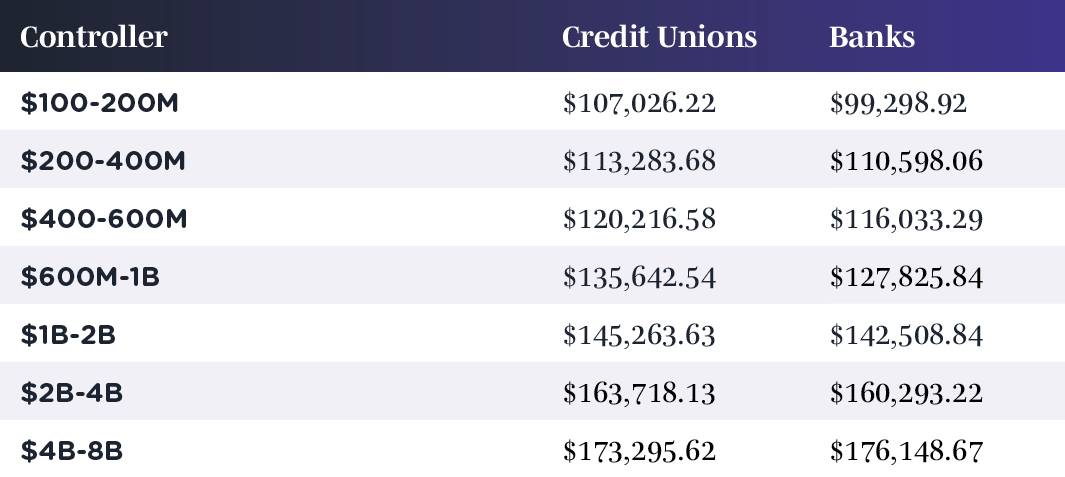

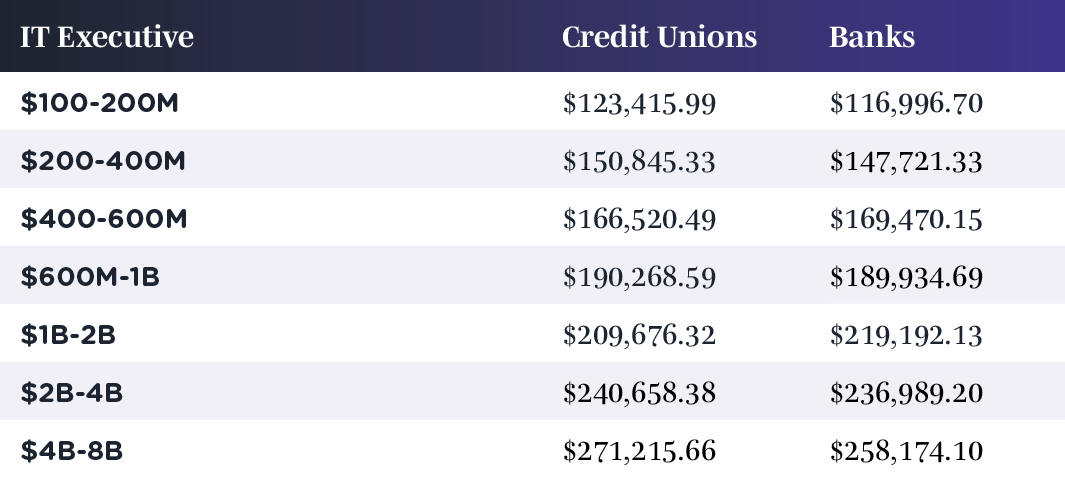

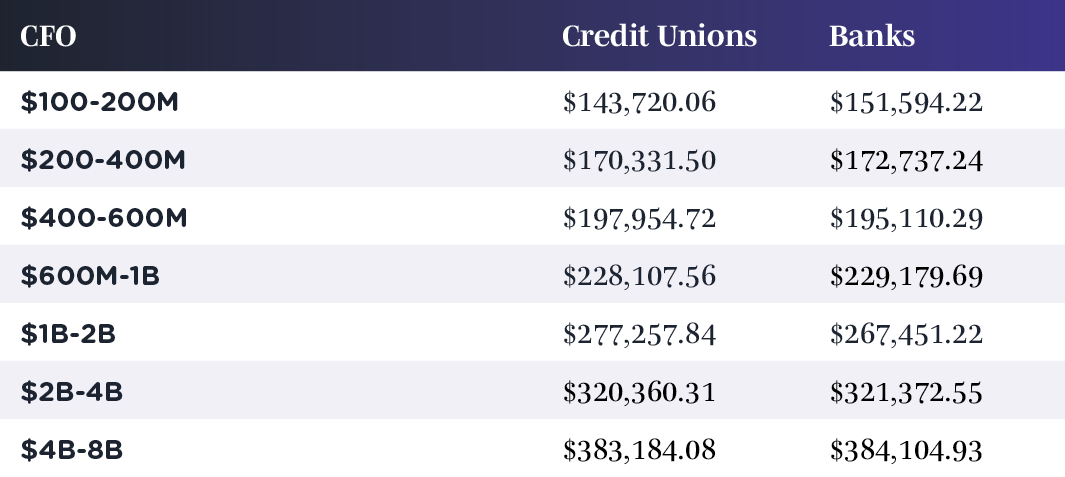

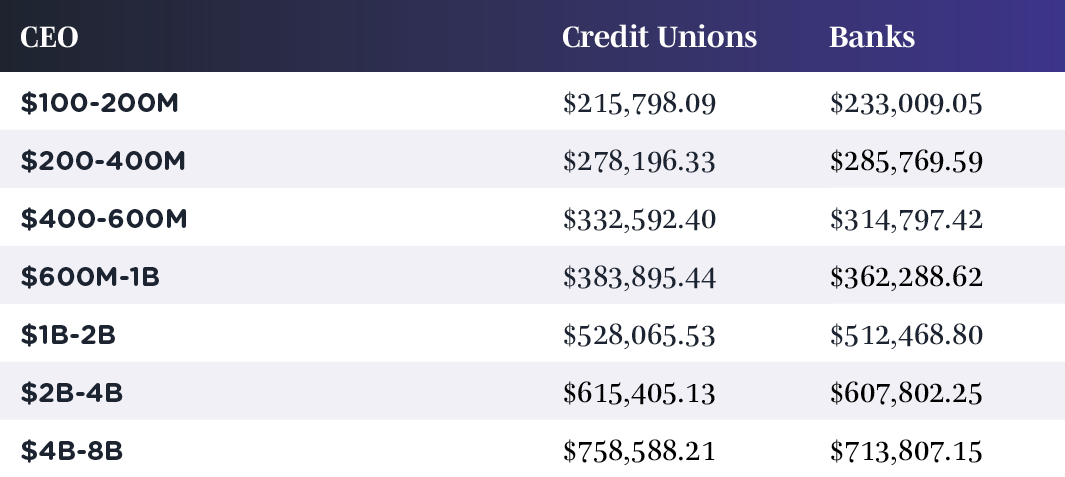

Below are the national averages for 17 common positions in financial institutions.

These averages have been trended to 7/1/25. In order to tailor the midpoints to your specific market, these salaries must be multiplied by your geographical wage differential (geo%). Although this compensation methodology is the definitive way to establish an organization’s salary ranges, it does not ensure a job-ready workforce for your area of the country.

We are able to produce this accurate and timely data and valuable insights through annual benchmarking of salary ranges. One of our most reliable sources of data comes from our in-house surveys.

We invite you to participate in the new BalancedComp 2025-2026 Salary & Incentive Survey for financial institutions, which will be open from March 25 through July 15, 2025. Participation is free and confidential, and if you do so in advance, you will receive $500 off the final price of the survey when it is published in September 2025.

Back to Blog