By Jordan Summervill

A Gradual Return to More Modest Labor Budget Increases

Last year’s salary ranges showed an average midpoint movement of 3.5%. It also was not uncommon for non-exempt staff to see larger than 5% midpoint movement in several ranges. Staying competitive in the market for your industry, asset size, and location meant budgeting for that 3.5% midpoint movement while leaving adequate room in the labor budget for differentiating for higher performance, as well as providing market corrections for the pay levels for those whose salaries are low in the range. The average labor budget last year was between 4.5% and 5.0%. Fast forward a year, and the average midpoint movement is closer to 2.8%.

2023-2024 – Slow Cooling of the Labor Market

While the projected midpoint movement was 3% in 2024, we saw 3.5% for non-exempt and 2.5 % for exempt & executive, with an overall average of 2.8%. Sources like World at Work, Mercer, and Payscale estimated 3.5 – 3.9% labor budgets, while BalancedComp maintained a projection of 4% with a recommendation of 4.5%. It’s worth noting that most surveys also show an additional 1% for promotional increases. So all in all, the projections are the same. These projections turned out to be in alignment with the banks & credit unions in the BalancedComp 2024-2025 Salary & Incentive Survey, as the average projected salary increase for the 2025 Merit Labor Budget was 4% for credit unions but 3.8% for banks. However, last year, banks projected a 3.7% increase in 2023 and later reported that they actually paid out 4.3% while credit unions were spot on at 4.5%.

- Last year, we anticipated wages to continue growing at post-pandemic levels, leading to less turnover. The 24-25 BalancedComp Survey report data supported this, showing turnover was reported at 16.5% compared to the 23-24 survey, which showed 20.5%.

- In 2022 and 2023, the BLS reported an average of 3.4% salary increases in the Financial Activities Industry. While Quarter 1 of 2024 still reflected this movement, Quarters 2 & 3, headed downward to 2.9% and then 2.1%. These are the lowest figures seen from BLS since quarter 3 of 2022.

Inflation is Down, Interest Rates are Easing Down

Security Cost-Of-Living Adjustments (COLA) have gone from 8.7 in 2022 to 3.2 in 2023 and 2.5 in 2024. In 2.5 years, inflation has gone down from 9.1% to 2.7%. While the Federal Reserve has brought rates down from 5 to 4.5% in the second half of 2024, consumers are still experiencing price increases well above the inflation rate.

The hope is that inflation will continue toward the Federal Reserve’s target of 2%, though it’s essential to recognize that this movement is not a reference for accurate or equitable pay increases. Aligning salary increases with inflation can turn into a broader issue of social equity rather than a strategic business decision to align pay with market data. In the wake of the Pandemic and Great Resignation, the labor market underwent major shifts, exacerbated by harsh economic conditions. Though we seem to be nearing the end of this economic turbulence, employers should continue making data-driven decisions and prioritize paying competitively based on market standards. Utilizing industry-specific market data and collaborating with industry compensation consultants to develop salary ranges and grades, ensuring expert guidance along the way, is crucial.

Loan Departments Remain Cooled off for Now

Many mortgage departments have seen headcount reductions due to significant price increases during the pandemic, high inflation post-pandemic, and the 7-8% mortgage rates we see today. Some organizations even closed their mortgage departments and outsourced everything to Rocket Mortgage.

Home prices rose around 4.5% in 2024 and are expected to nearly match that again in 2025. 30-year fixed mortgage rates have come down a bit from 7.8% to 6.5%. These rates were lowered this fall, and mortgage application rates are expected to go up in response in early 2025.

In 2022, seven out of the 30 fastest-growing salaries were within the Mortgage department. This salary growth has cooled off while home buyers wait for interest rates and pricing to return to lower levels. However, mortgage salaries are still seeing growth during this period. Last year, the Mortgage Loan Underwriter made the list of hot jobs. This year, the Mortgage Sales Manager and Mortgage Loan Officer (mostly base pay) were both on the list. Employee-centric banks and credit unions may seek to keep their top performers by raising salaries as normal commission levels are not attainable, at no fault of the employee.

Salaries in Risk, Compliance, and Audit Continue to Thrive

Despite recent economic fluctuations, banks and credit unions will require highly skilled specialists to navigate the complex regulations and rules specific to the financial sector. The demand for such expertise, coupled with the specialized knowledge required, often necessitates higher compensation to ensure these institutions remain competitive. The following Risk-categorized positions made the list of fastest-growing salaries (in order):

- Head of Risk (4th year in a row)

- BSA Analyst

The complexity and volume of risk management in the financial sector remain significant, especially with the continued growth of electronic banking and cybersecurity. It’s important to remember that, similar to the Tech department, the Risk department can still be targeted by other industries seeking the same specialized skill sets, particularly for leadership roles such as the Head of Risk. Non-exempt roles in the compliance department are often internally recruited and “homegrown”. After being trained by one employer for three or more years and receiving the standard 3% – 4% salary increase, employees can find that the market is willing to pay them significantly more.

Accounting Salaries Are Rising Quickly

In 2024, accounting positions experienced faster-than-usual salary growth. With advancements in technology, changes in tax laws, and the growing complexity of financial tasks, companies are seeking fresh talent to manage these challenges. As businesses compete for qualified candidates, salaries are rising to attract individuals with the necessary skills and expertise. This trend reflects the growing value placed on accounting professionals across various stages of their careers in several different industries. The following Accounting positions are among those with the fastest-growing salaries in 2024 (in order):

- Payroll Specialist

- Accounting Specialist I (2nd year in a row)

- Accounting Manager

- Accountant II

IT Positions Remain Key

Information Tech positions continue to be in high demand across several industries, fueling intense competition for both recruitment and retention. With the continued rapid advancement of technology, including AI, cybersecurity, and cloud computing, there is a real need for specialized experience. Businesses are increasingly relying on IT professionals to secure their systems, optimize operations, and manage digital transformations. New skills are needed for core processors in the cloud, administering sophisticated CRM systems, and building proprietary applications.

Additionally, the growing prevalence of remote work and the global talent pool have expanded opportunities, intensifying competition for top talent. Pay transparency laws make it easier for employees to spot when they are paid less than the market. Within this key area of support, the following IT positions made the list of fastest-growing salaries (in order):

- Information Security Officer

- Software Developer/Engineer (2nd year in a row)

- Network Administrator

Some new technology positions are appearing in the banking industry to include:

- Scrum Master I & II

- Salesforce Administrator

Readjustment in the Labor Market

The total unemployment rate has been under 4% since February 2022, rising to an average of 4.2% in May 2024. However, unemployment in the Financial industry was 2.2% in 2023, and that has risen to 2.5% in 2024.

Recruitment and retention continue to pose significant challenges for many employers. However, the impact of The Great Resignation—also referred to as “The Great Readjustment”—has prompted meaningful progress, with companies offering improved pay, benefits, flexibility with some remote work, diversity, and greater attention to employee wellbeing. While wages are still rising at post-pandemic levels, employees report higher job satisfaction, though many remain open to opportunities that could enhance their career prospects. Organizations prioritizing employee satisfaction and competitive compensation are strategically positioned to maintain a strong, engaged workforce in the evolving market.

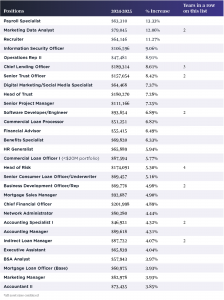

Based on our primary research, the following are the top 30 positions that have seen pay increases 150-500% faster than the average annual market rate. Interestingly, this includes some executive positions and jobs that require a high school diploma.

According to 2024-2025 BalancedComp Salary & Incentive Survey research data, these are the 30 fastest-growing salaries by job title in the financial sector for the upcoming year:

Back to Blog