By Christie Summervill

Community banks and credit unions are setting a remarkable standard in the financial sector by effectively eliminating pay disparities related to gender and minority status. A comprehensive analysis conducted by BalancedComp, a consultancy specializing exclusively in financial institutions, reviewed data from over 300 client banks and credit unions with assets between $50M and $12B, representing over 67,000 employees. The findings unequivocally show that these financial institutions are at the forefront of the national efforts to eradicate pay discrimination within the U.S.

In 2024, a woman in the U.S. is paid 84 cents on the dollar compared to their male counterparts, up from 82 cents in 2020.

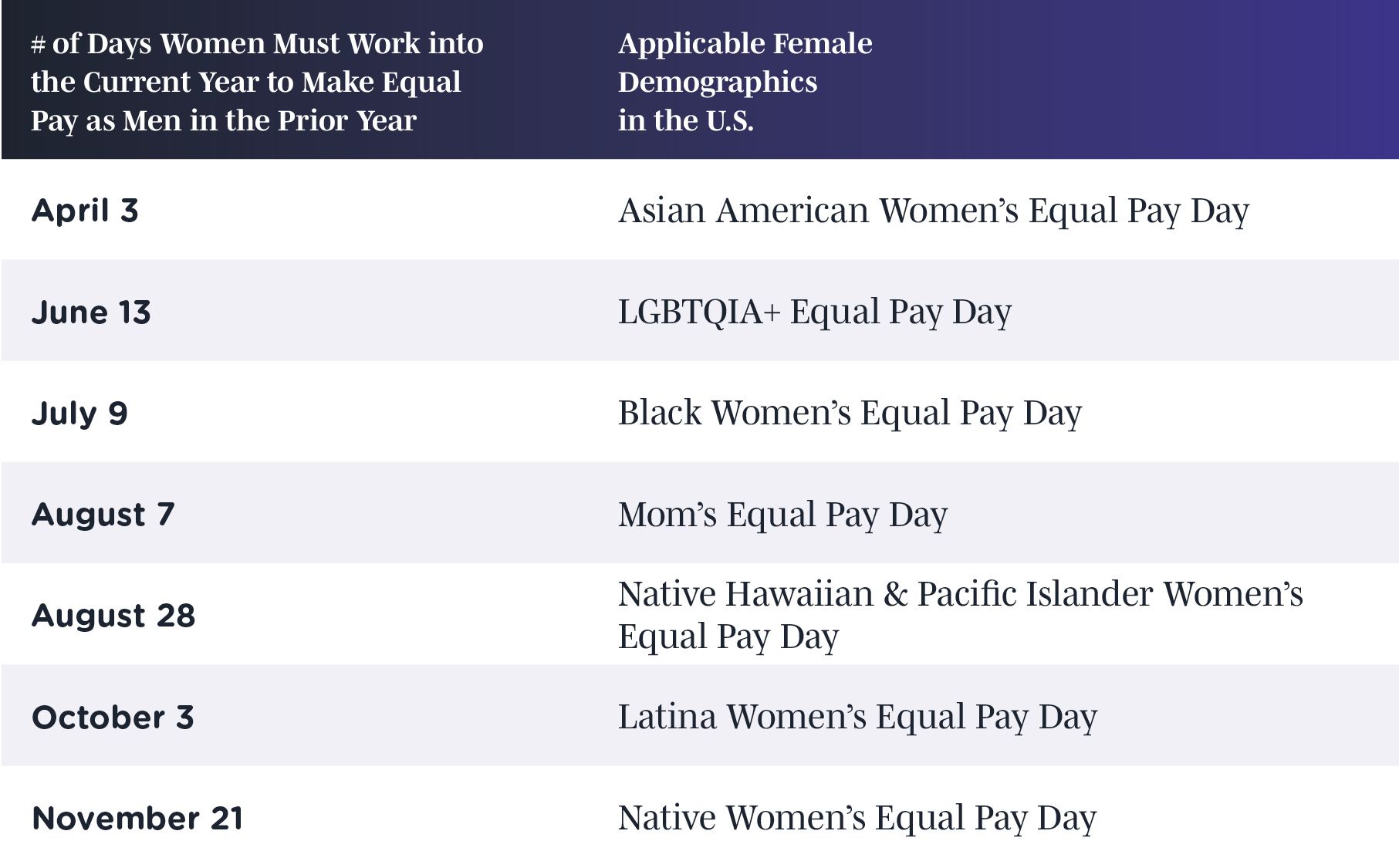

Equal Pay Day represents the number of days women have to work into the current year to make the same amount of money men made in the prior year. This year, women must work approximately 14.5 months to equal the contributions of an average man’s median wages. See below:

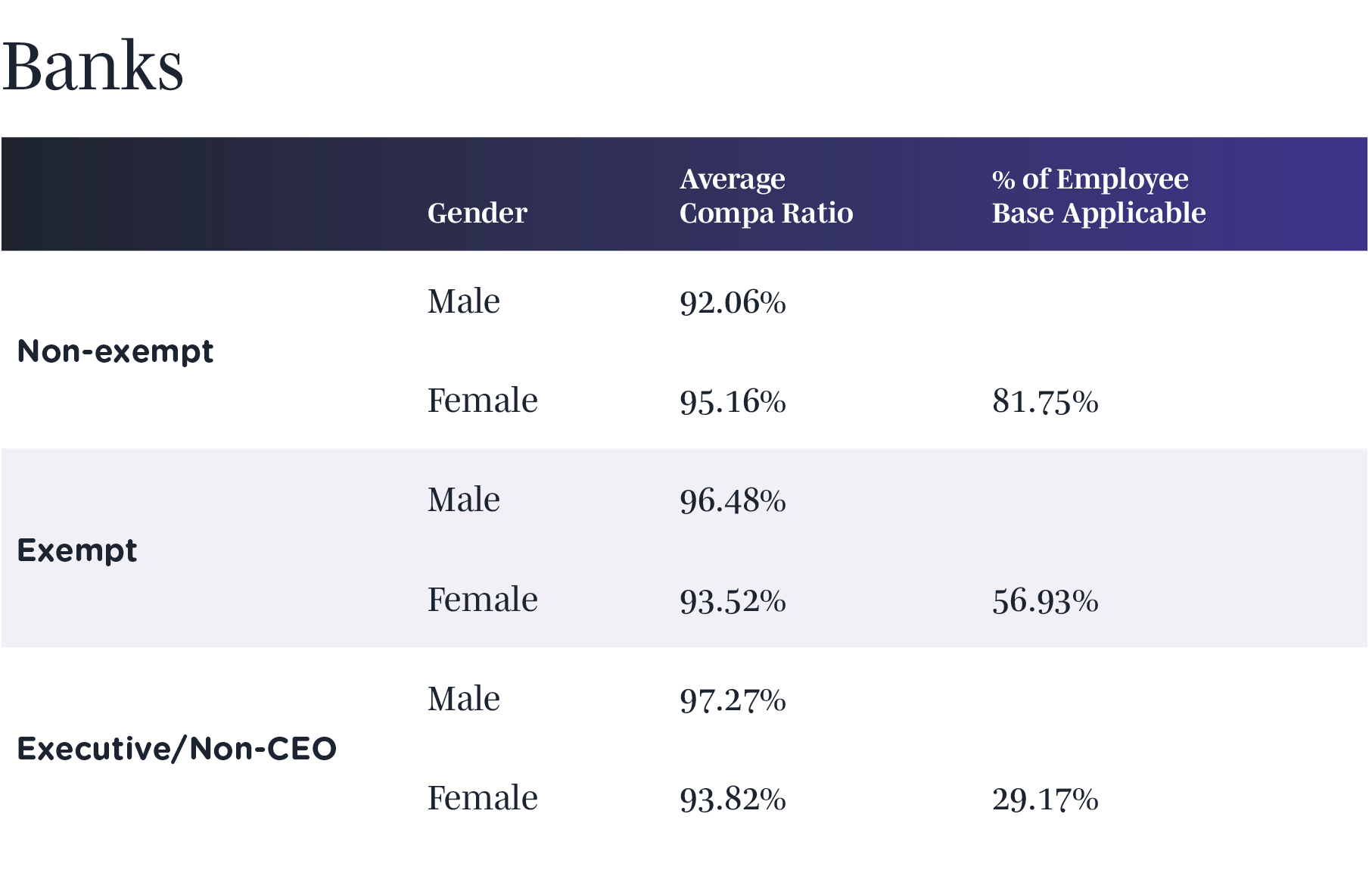

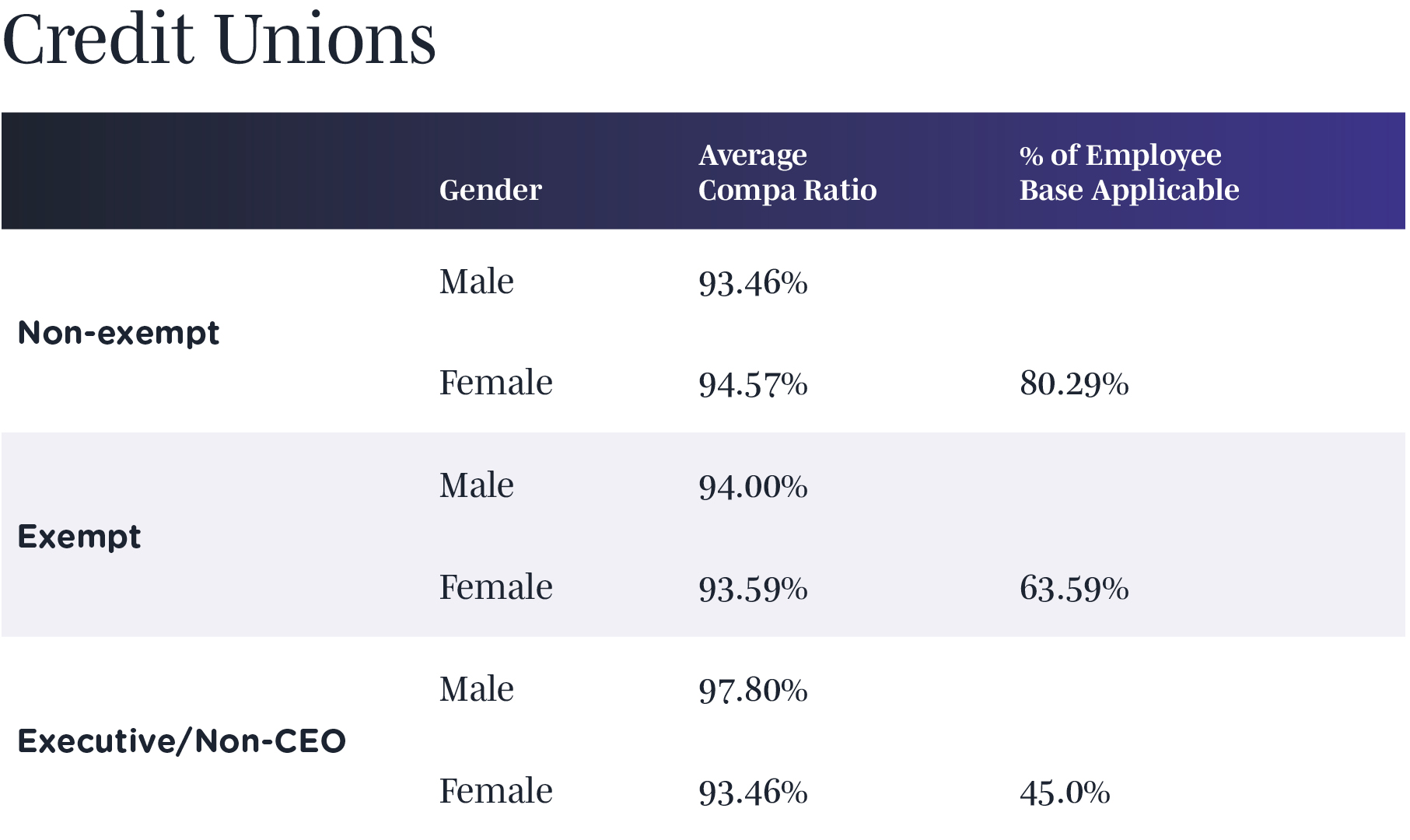

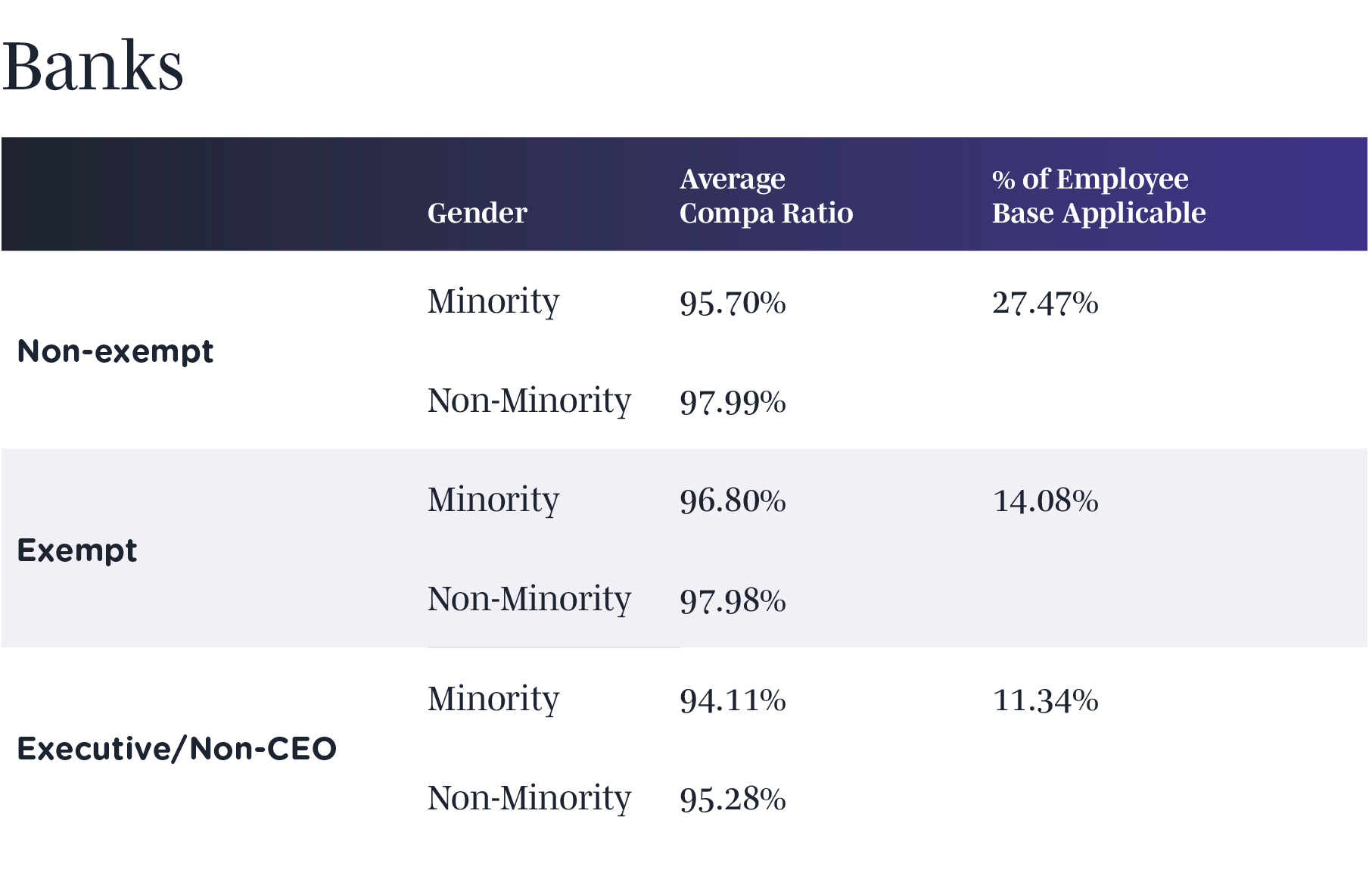

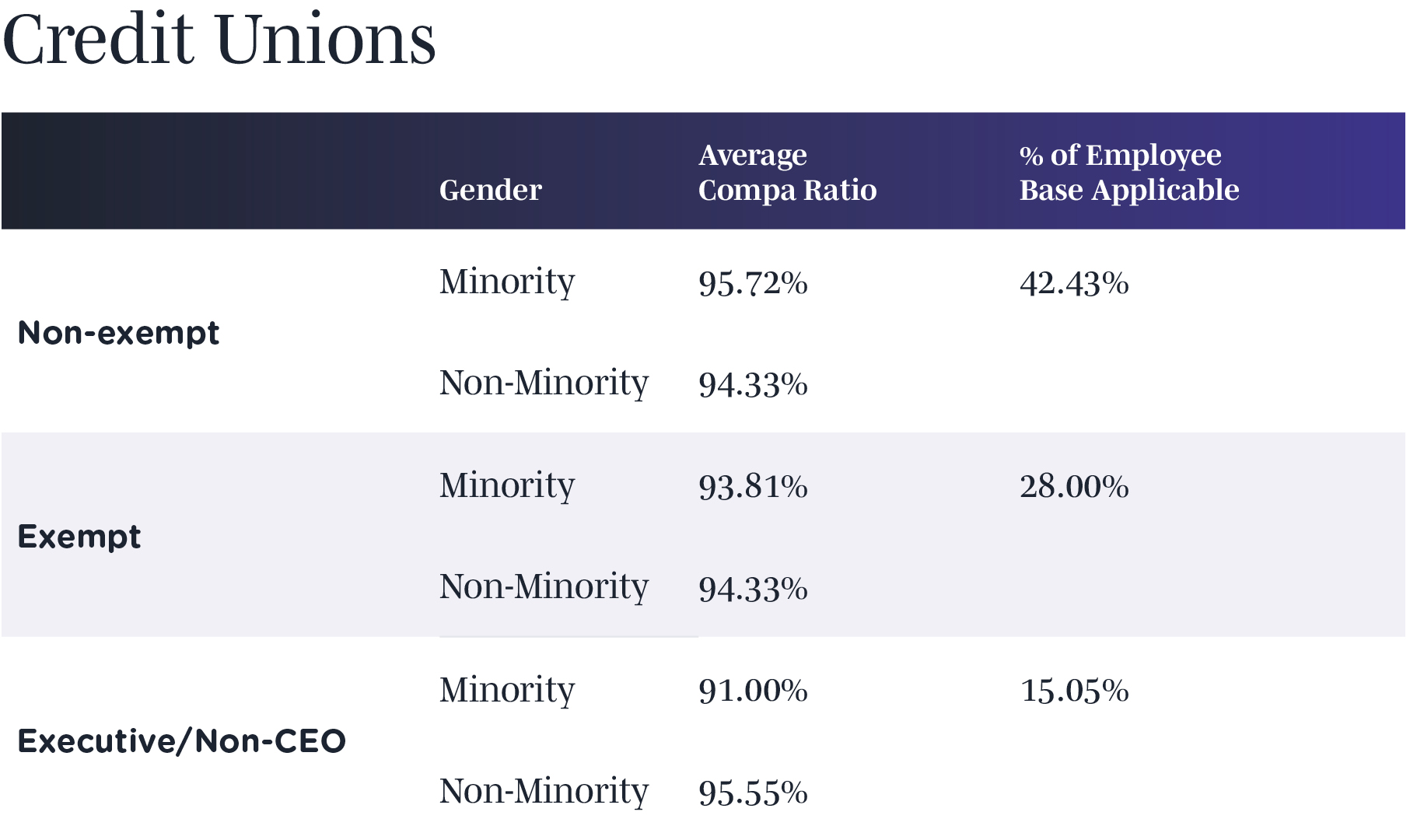

U.S. financial institutions have long recognized that effective customer relationships are the key to success. It is unsurprising that the compa ratios (current pay levels divided by the midpoint of the salary range) from over 300 clients in this data set show that women are paid between 95%-103% of their male counterparts, and minorities are paid between 95%-102%.

“With consumer loyalty fading to the same degree that branch visits are diminishing, it is important to attract and retain an employee base that represents the customer base, and paying two people for the same job with the same qualifications for the same amount of experience in their roles should be without question,” according to Christie Summervill, CEO of BalancedComp. Of course, this data is not from the industry at large. Still, from clients using our compensation consulting firm, it is evident that they have implemented the methodology to know if their pay levels are competitive with the market. This makes good decision-making easier.

Derived from clients who utilize our compensation consulting services, this data ensures they have the discipline to accurately assess how their pay levels compare to the market, facilitating informed decision-making. However, further progress is essential, particularly in increasing the representation of women in executive roles within banks to better reflect women’s educational attainment in the broader market. According to the latest data from the U.S. Census Bureau, approximately 42% of women aged 25-64 in the U.S. hold a bachelor’s degree or higher. This underscores the need for greater female representation at the executive level in the banking industry.

* Gender data from 59,630 employees across 294 clients.

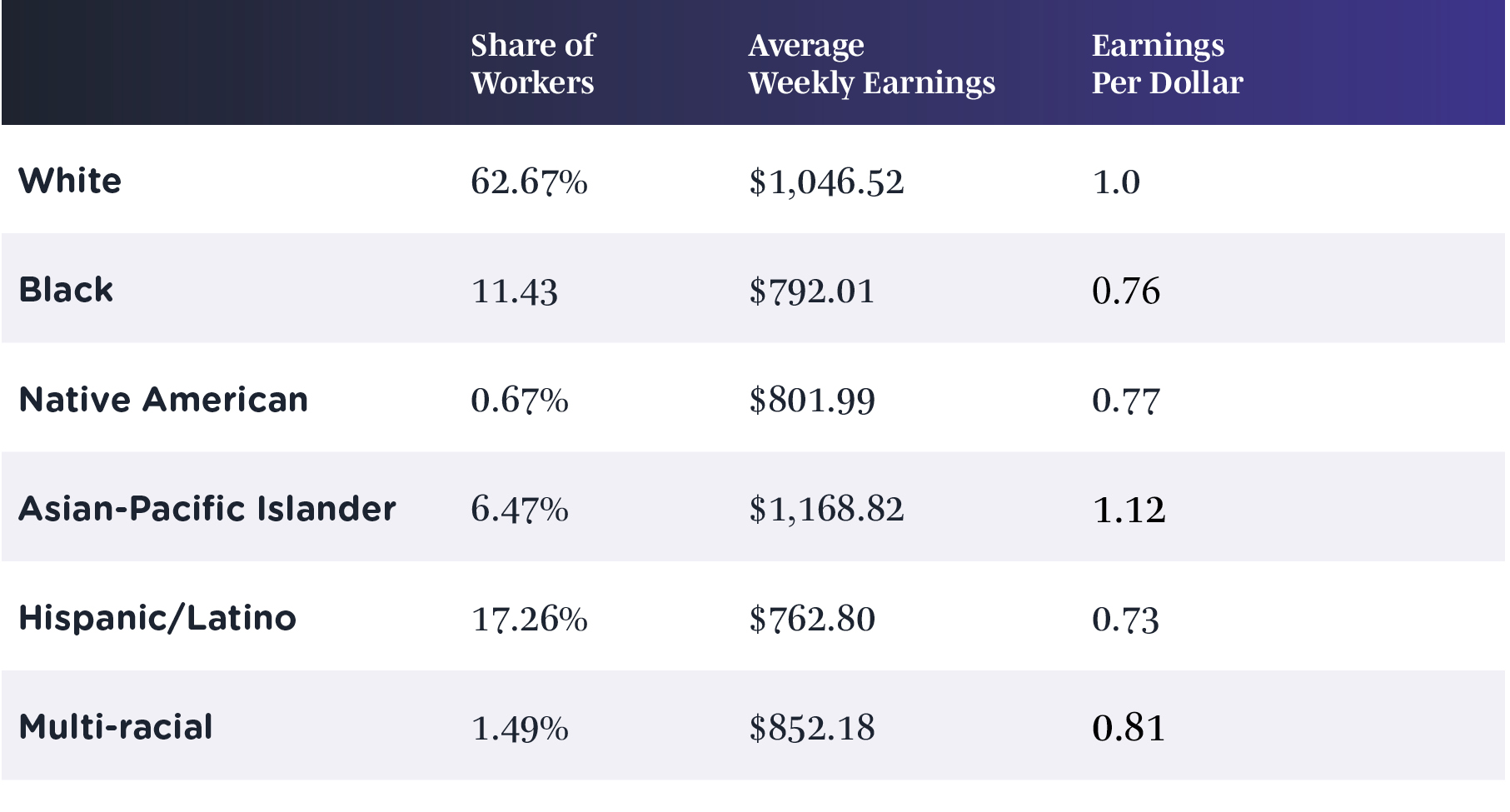

Credit unions and community banks have also taken significant strides in advancing pay equality among minority groups, mirroring their efforts in gender pay equity. Although minorities constitute 33.76% of U.S. college graduates, disparities in earnings persist nationwide. Except for the Asian-Pacific Islander group, other minority groups earn between 73% and 81% of the salaries of their white counterparts, as illustrated below.

Bureau of Labor Statistics 2024 for 2023

* Minority data from 36,850 employees across 180 clients.

Hiring and attracting a talented workforce that includes gender and race is directly linked to financial success for any company, and we commend and applaud the success achieved by financial institutions that have obliterated the stain of pay disparity based on gender and minority status. Diverse teams bring a wide range of perspectives, experiences, and ideas that drive innovation and problem-solving—critical components of competitive advantage in today’s complex financial environment. If there were room for improvement in these numbers, it would be in the percentage of minority executives hired.

Research consistently shows that organizations with diverse leadership and employee bases are likelier to outperform their peers in profitability and value creation.

Moreover, inclusivity in hiring practices enhances a bank’s or credit union’s ability to understand and serve an increasingly diverse customer base, fostering stronger relationships and customer loyalty. By committing to gender and racial diversity, financial institutions promote equity and position themselves for long-term success in a rapidly evolving market.

It all starts with the data

The financial institutions in this subset aren’t necessarily more socially justice-minded than the industry at large. They implemented the discipline and methodology to know with certainty how pay compares to the market. BalancedComp is thrilled to partner with its clients in their success in this area.

Back to Blog