By Christie Summervill

After recording high pay raises in 2023, today’s stressed talent market is primed to continue driving employee compensation even higher next year—a reality that puts added pressure on HR professionals to get their salary budgets right even as companies struggle in the current interest rate environment.

The average projected salary structure movement (from the 2023 midpoint to the 2024 midpoint) is around 3.5% for exempt and 3.0% for non-exempt. The average labor budget is projected to be 4.5% – 4.7%. A typical 3.5% – 4.0% salary increase would mean employee pay levels would cease to move any closer to the market midpoint, regardless of performance or time in position, and would likely increase unnecessary turnover. Even with a 4.5% budget, more benchmark positions with average salaries are moving twice as fast as this consultant has ever seen.

By advocating that your 2024 salary budget be increased to 4.5% – 4.7%, you will reduce the amount of unnecessary turnover and help ensure that those you would typically promote one year later into other positions will still be onboard. Your base salaries should plan on a separate 2% promotional budget.

“Not budgeting this amount could be the worst money ever saved.”

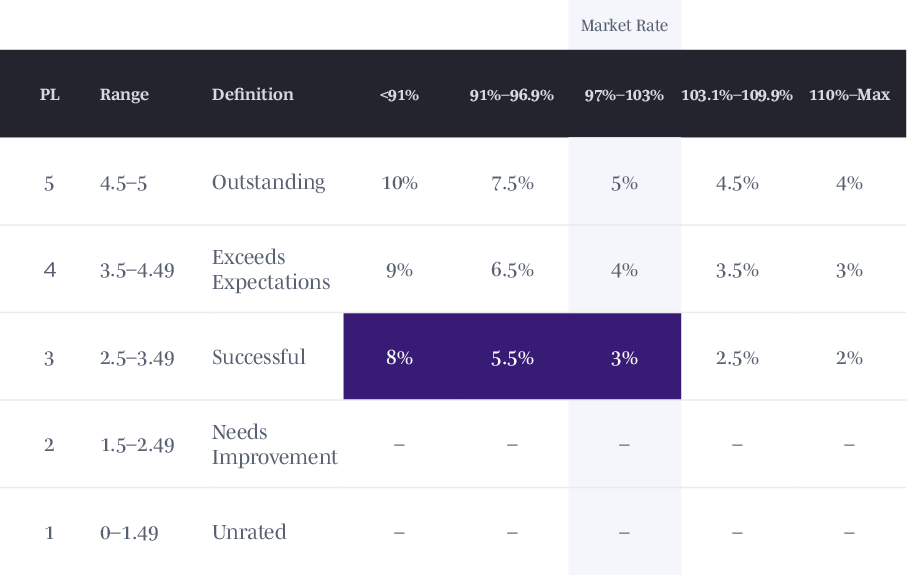

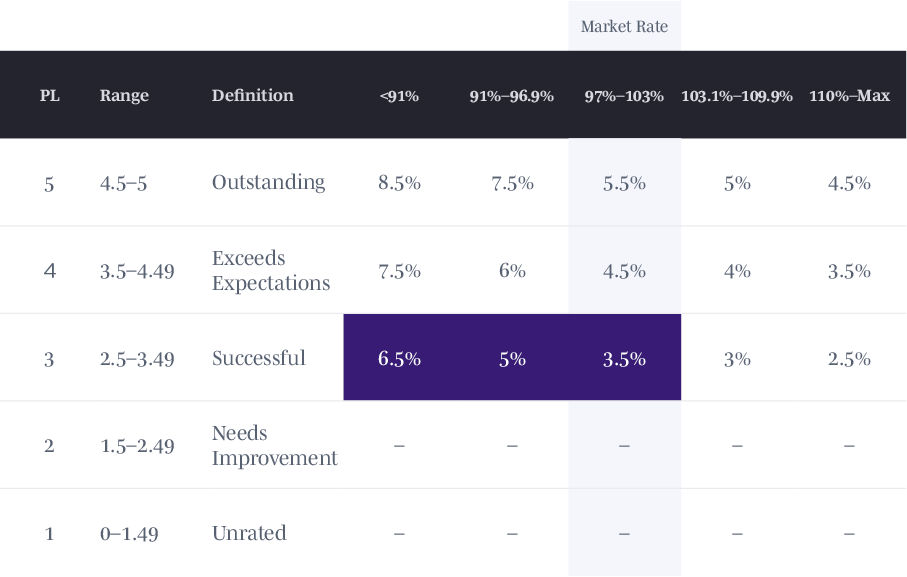

When developing an effective labor budget matrix, keep your eye on the percentage where “Meets Expectation” intersects with the “Market Rate Compa Ratio” (between 97% – 103%) at all costs. In 2024, that number projects at 3.5%. Consider how much salary increase your top-rated performers should receive over your “Meets Expectations” rated performers. Suppose the pay difference between higher-performing employees is only an additional 1%. In that case, the message received is “performance does not pay here,” which leads to higher turnover or even quiet quitting.

Ideally, your range of performance classes should have at least a 2% difference to account for “paying for performance” among your highest-performing employees. Paying this difference ensures that higher-performing employees’ pay levels move closer to the midpoint more quickly, reducing the need to spend time on recruiting sites. Too often, only employees whose managers are willing to go to bat for them receive a higher salary increase.

If a non-exempt employee is new to the company or to the position due to an internal hire, their compa ratio should be 85% of the midpoint. The same is true for executives if the company recently moved its peer comparison group to a larger asset size. By having a starting pay at 80% of the midpoint, you essentially say, “Our starting pay is at a level that less than 10% of our competitors would pay.” You need an additional 5% over the 3.5% so that their pay level will meet the market rate expectation within three years if you are operating in a regular market. (See Matrix A). Exempt employees should reach their midpoint within five years, with their difference set at a 3% market rate movement year over year. (See Matrix B).

Hot jobs with salary movement twice as fast as the market may need a 10% premium added to their midpoint before running your budget. Such roles may include key IT positions, Commercial Loan Officer, Information Security Officer, Senior Credit Analyst, Head of HR, Head of Marketing, and some hard-to-fill Compliance jobs. With the Fall BLS reporting 22% in Teller salaries due to 66% of credit unions and banks raising wages for the front-line staff twice last year instead of one, you may also include this position in the group.

Not all jobs have salaries skyrocketing. Interestingly, salaries for Mortgage Sales Managers, Consumer Loan Managers, Indirect Loan Representatives, Treasury Sales Officers, and Deposit Operations Reps were significantly less than the average market rate movement. It is possible that for some of these positions, more compensation was directly tied to either incentive or variable pay.

If you cannot get approval on the above amounts, it would be advisable to lessen the difference for performance to 1.5% over slowing down movement to the midpoint. Recruiters made a fortune in the past two years recruiting employees with five years of experience in their roles but paid under the midpoint salary. The average salary increase for those who left for money was 16.1%. They likely didn’t have to find jobs that paid outside of the salary range of the current employer if their previous employer had the discipline of moving pay levels to midpoint over a reasonable period.

If there was ever a time when a board should recognize the need to move pay levels to a competitive market rate, it is now!

Having a family-friendly work environment and a positive work culture is a minimum expectation and will not suffice to keep good employees. High-performing financial institutions plan to give employees more significant raises one more year despite struggling with the current interest rate environment.

We make this process easier for our clients with our best-in-industry web-based software packed with data from over 20 sources all tailored by asset size and geographic location, and our team of expert HR consultants. Our compensation and salary experts team ensures that every financial institution pays for performance while meeting the market. To learn more about our flagship BalancedComp salary administration software, please schedule a demo today.

Back to Blog