By Christie Summervill

With the release of the 2025–2026 survey, comparing current findings to those from the 2019–2020 edition provides a useful lens into how compensation practices for Mortgage and Commercial Loan Officers have evolved during two distinct periods of economic disruption.

Mortgage Loan Officer/Originator/Representative (MLO) Compensation

The 2019–2020 survey, which reflected data from 53 community banks and credit unions with average assets of approximately $650 million and 141 MLOs, captured compensation practices just prior to and into the early stages of the pandemic. At that time, our letter to CEOs acknowledged the rapidly changing environment, noting the decline in loan demand, reduced branch traffic, and slowing consumer and commercial activity, which was offset slightly by significant deposit growth. Institutions were encouraged to reassess their goals and incentives mid-year and reconsider their overreliance on traditional KPIs, such as loan growth and yield. Many performance scorecards were under pressure, and plans that relied heavily on variable compensation risked disengaging strong performers who were unable to meet targets due to factors beyond their control.

Both the 2019–2020 and 2025–2026 lending surveys provide detailed benchmarks on base pay, incentive opportunity, production volumes, and plan design, with a consistent theme around the importance of flexibility as market conditions shift.

The average annual lending volume for MLOs was $12.5 million in 2019-2020, with average total cash compensation (base + incentive) of $78,428. On average, 63% of compensation was delivered through variable pay. Plans with lower base salaries (averaging $33,000) and higher commission potential resulted in higher total cash compensation, averaging $105,536, and tended to attract higher performers with portfolios exceeding $20 million. By contrast, plans where variable pay represented less than 50% of total cash compensation averaged $64,689 in total pay, with average portfolios of $7.1 million. Pure base-pay roles with eligibility only for a corporate bonus averaged $62,120 in total cash compensation, with surprisingly higher average portfolios of $10.7 million. Approximately half of the responding institutions used tiered commission structures, most commonly with three tiers, where higher basis points (bps) were paid out as productivity increased.

In 2020, nearly 60% of MLOs were also eligible to participate in a companywide bonus program tied to organizational performance, in addition to their individual incentive plans. By 2025, participation in corporate bonus programs had declined, reflecting a broader reassessment of overlapping incentive structures.

Fast-forward to the 2025–2026 survey, which includes data from more than 70 institutions with average assets of $1.5 billion and 373 MLOs, and we see a lending environment facing a different set of challenges. Elevated interest rates, limited housing inventory, and continued market volatility have constrained originations. Despite these headwinds, the average number of MLOs per institution increased from 3.5 to 5.2. Companies appear to be willing to share a greater portion of the profits with MLOs. Average total cash compensation for Mortgage Loan Officers rose to $112,778 (median $79,125), with $49,547, or 43%, delivered through incentives.

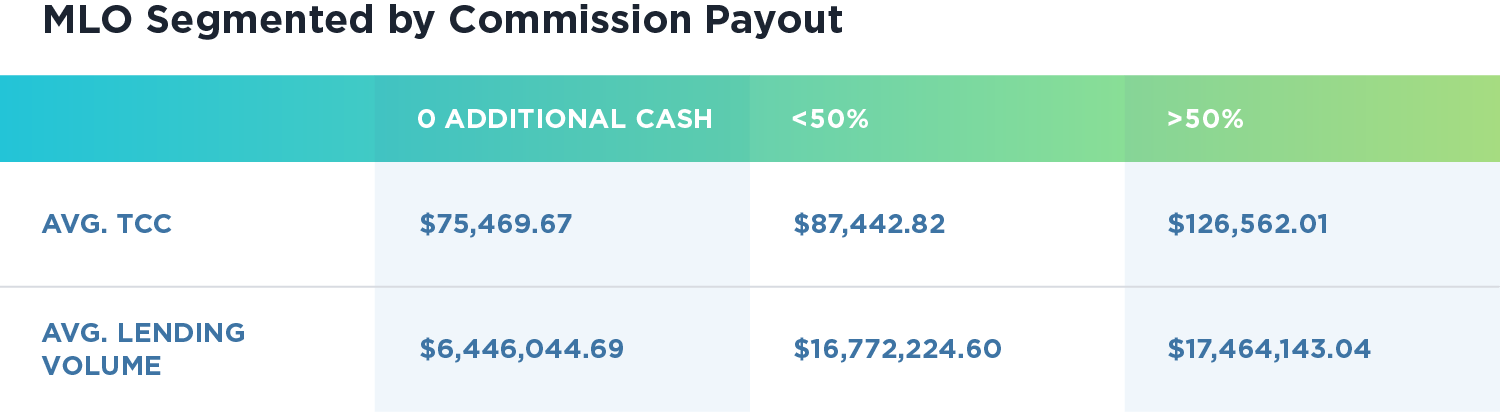

Average productivity was reduced by nearly $5M to $15.9 million, signaling continued pressure to balance competitive pay opportunities with realistic performance expectations in a constrained market. MLOs at organizations with incentive plans that comprised more than 50% of the total cash compensation averaged a TCC of $126,652 and an average production size of $17.5 million. MLOs employed at organizations that paid less than 50% of the TCC in incentives had an average total cash compensation of $87,443 and carried an average production volume of $16.8 million. If the pay plan were purely based on base (no incentives), the MLO averaged $59,969 and carried an average production volume of $6.4 million.

The 2019–2020 survey also showed that 50% of Mortgage Sales Managers received incentive compensation based on team production, while 77% also earned incentives on their own individual production. The 2025–2026 survey expanded its focus on the Mortgage Sales Manager role and reflects a shift in design. The average base salary for Mortgage Sales Managers is now $100,000, with average variable pay of $30,000 based on a combination of individual and team performance. Only 44% of managers now receive incentives tied to individual production, reducing internal competition with direct reports. The average total department production was $72 million (median: $48 million).

The expanded 2025 survey also showed that only 40% percentage of respondents pay incentives to the Mortgage Loan Processors.

Commercial Loan Officer/Business Loan Representative Compensation

On the commercial side, the story is markedly stronger. Base pay averages between $100,000 and $110,000 across all asset sizes, driven by robust demand for business financing, except in portfolios under $7M, such as those with a new CLO. There are often three separate salary grades and ranges for this role, based on the portfolio size, which drives the amount of experience, complexity, and impact on the organization. Total compensation frequently surpasses $150,000 for experienced officers with larger portfolios, driven by bonuses tied to portfolio growth and relationship metrics. This surge aligns with record SBA lending in 2025: over $30 billion in 7(a) approvals across 70,000+ loans, up 13% in volume and 22% in count year-over-year. Small-dollar loans under $150,000 now dominate over 50% of approvals, reflecting entrepreneurial booms and policy support for underserved borrowers. Community lenders have capitalized on this, expanding portfolios in small business sectors.

In 2019-2020, variable pay was paid out annually 75% of the time. Fifteen percent of the time, it was paid quarterly, and 10% was paid monthly. More than 50% of the time, the CLO incentive plan is based on 4 or 5 factors. Only 19% deferred any incentive pay to assess portfolio performance or asset quality. In the 2025-2026 survey, this number lowered to 15%. In both surveys, the head of Commercial Lending was expected to produce as well as manage in 60% – 67% of the cases across both surveys.

In 2019-2020, the average Total Cash Compensation was $116,438, comprising 16.25% of base pay, with an average incentive amount of 10.79% and a median of 10.79%. This demonstrates a higher statistical deviation, resulting in more outliers and some extreme values. The average portfolio was $30M. With the average net margin during this period for a business loan being near 4.5%, that means the average net income a Commercial Lender brings to their employer is $1,350,000.00 in addition to other products the organization may sell to the client by expanding the relationship.

In 2025-2026, the survey results averaged a Total Cash Compensation of $155,000 (median: $140,000), comprising 18% of base, and an average incentive amount with a median of 13%. The average portfolio was $60M. Base pay can vary between $87K and $173K before being adjusted by the geographical wage differential based on the portfolio size. With the average net margin for a business loan being near 3.5%, this means the average net income a Commercial Lender brings to their employer is approximately $2,100,000.00, in addition to other products the organization may sell to the client by expanding the relationship.

Looking Ahead

Our 2025–2026 survey also provides detailed pay benchmarks by tenure and portfolio size, along with sample incentive plan designs for both mortgage and commercial roles.

Taken together, these surveys reinforce a clear lesson: effective lending compensation programs are responsive by design. The most successful plans strike a balance between meaningful performance rewards and thoughtful guardrails that account for market volatility. For community financial institutions, remaining competitive means pairing sound data with local insight to ensure that compensation programs continue to motivate, retain, and support lenders as they drive lasting impact for members, clients, and communities.

The 2026-2027 BalancedComp Lending Compensation Survey will open for participation in March 2026 and will remain open through November. It will be available for purchase in December for $995. All participants will receive a $300 discount.

Back to Blog