By Jordan Summervill

The labor market is showing trends of stability and cooling, while still maintaining solid levels above the average. This time last year, whether The Great Resignation would continue into 2023 was still being determined. Unemployment was at 3.4%, interest rates were 5%, inflation averaged 8% in 2022 and 5-6% in early 2023, and wage growth showed historical projections of 4-5% increases. Recruiting and retention were a significant challenge for banks and credit unions, with many looking to increase their staff. However, the market remained strongly employee-driven. Employee packages were increased, revamped, made more flexible, and out-of-cycle salary increases were being given out more often than not. However, from the Spring of 2021 to the end of Summer 2023, workers could be given these offers and feel comfortable negotiating for better terms or leaving and finding something else. 2024 provides dynamic shifts and settling to these recently turbulent labor market conditions.

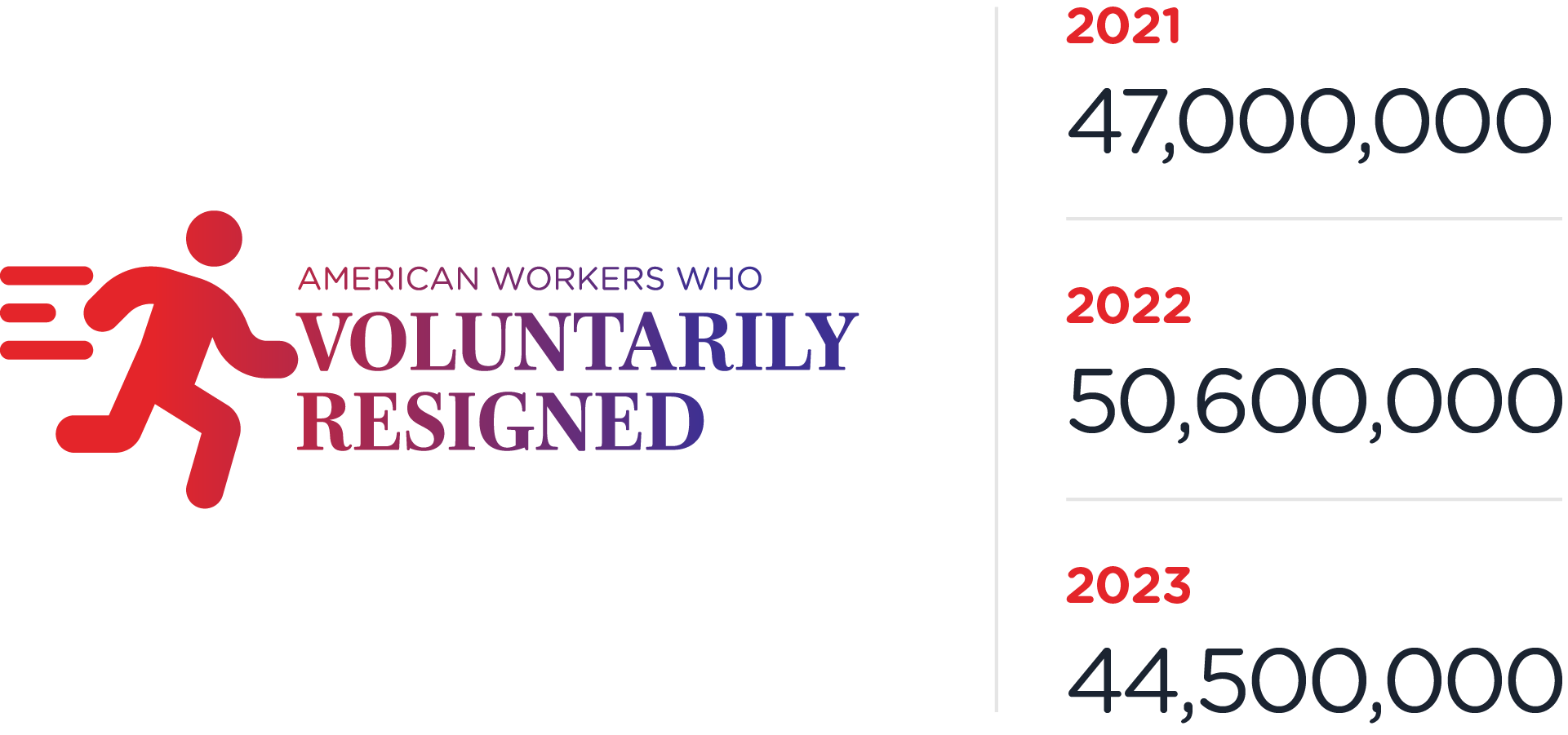

The Great Resignation ends, prompting The Big Stay

The Great Resignation era was unofficially declared over in the Summer of 2023. This reshuffling marked a pivotal juncture for employees seeking positions that resonated more closely with their career aspirations. This widespread movement in the job market empowered individuals to prioritize their preferences and secure roles within organizations that aligned with their motivations and goals, whether in terms of salary, work-life balance, or personal values. As a result, many successfully realigned their professional lives with their expectations. They joined companies offering a more fulfilling fit, reducing their incentive to seek new employment, leading to a new transitional period of increased stability often referred to as the “Big Stay.” Now the question of 2024 is, “How long will this Big Stay last?” and “Is anything else contributing to this trend of employees holding tight in their current positions?”

What’s different now?

Many factors in today’s market are actively shaping the landscape to support this new period of stability in the workforce. In general, work-life standards have progressed rapidly for millions nationwide in the last 2 years.

- Significant improvement in corporate compensation & benefits packages

- Jobs allowing more flexibility with hybrid schedules are far more prevalent

- Opportunities for career advancement are more available

- Companies are focusing and investing heavily in employee engagement and well-being

- More corporate rewards/incentive programs are either being implemented as of this year or getting revamped to stay competitive

- Workforces are adopting policies that promote diversity, equity, and inclusion (DEI)

Less overall job openings and hiring mean less people quitting.

- The Bureau of Labor Statistics (BLS) reports that job openings are down from 12 million in March of 2022 to 8.8 million in November 2023

- As compared to 2022, there were record-high job openings in the Financial Activities industry, showing 77,000 more job openings on average than 2023 (which reported a 18% decrease). To note, this industry’s current job opportunities are still extremely high compared to anything seen in the last 25 years

- As of November 2023, the total number of US job postings on Indeed in the Banking & Finance sector are down 33% over the last year

- While these numbers are high compared to average norms, they do reflect a downward trend

More companies, while still hiring, are less likely to create new positions, instead choosing to backfill open positions and increase selective departments.

- In the 23-24 BalancedComp Salary & Incentive Survey, out of 114 Banks & Credit Unions, 46.5% (nearly half) of them planned to maintain current levels in 2023

- 58% of our 2023-2024 survey participants reported an overall increase of staff in 2022. Plans for 2023, however, saw an overall increase drop to 25% and organizations planning to increase in certain departments went from 0 – 22%

- The Federal Reserve Beige Book released in February 2024 showed that some bankers reported hiring only for strategic positions

The tides are turning within the labor market, dropping confidence.

- Job switchers are no longer being rewarded with 8-15% salary jumps the way they were for the past 1-2 years. There are now less options available as employee demand cools off.

- The Beige Book’s Summary of Economic Activity did report, however, that new hires continue to receive elevated wage gains. Due to the increased worker availability, employers were able to be more selective in their hiring process and promptly replace underperforming workers. However, recruitment efforts for specialized and highly skilled positions are proving to be a challenging endeavor.

- While many workers still may not be completely satisfied in their current role, they have limited alternatives.

National turnover across the U.S.

Last year, the quit rate was 2.4% across sectors and 1.5% in the Financial Activities industry. Today, the national quit rate is down to 2.1% across sectors and 1.3% in the Financial Activities industry. There is, however, a slight increase in voluntary terminations in the Information industry.

While the national quit rate has decreased, unemployment has risen by 0.2% to 3.9% as of February 2024. Specific to the Financial Activities industry, the unemployment rate is now 2.4%. Similarly, although lower than pre-pandemic norms, the number of unemployed persons per job opening is higher than the last two years.

2.7 million jobs were created in 2023 which remains elevated to average norms while also reflecting a downward trend from 2022. If fewer jobs continue to be made and posted, the unemployment rate may continue upward, creating less worker demand, which could lead to layoffs. Surveys are reporting that from this increase in employer bargaining power, some companies have diminished their remote work arrangements and rewards programs. While this is the understandable balancing act of being an employer, hurrying back to pre-pandemic norms during this climate may lead to job seeking, loss of talent, loss of job satisfaction, and quiet quitting. This particularly applies to younger generations, Gen Z and Millennials, who report that transportation and childcare expenses are significant obstacles for entry-level candidates.

How are interest rates looking?

Interest rates have been at 5.5% since late July 2023. With inflation averaging 4% last year, Federal Reserve officials continue to evaluate for signs in the market that would warrant a cut to the rates. However, surpassing expectations, the Consumer Price Index (CPI) had an annual increase of 3.2% in February 2024 reflecting strong economic growth.

Will wage increases be following this gradual downward trend?

While wage increases may seem to be cooling down, they are currently settling above historical averages. This could be due to a notable increase in productivity in 2023 (BLS). While annual productivity typically increases around 1.5%, Q1-Q3 of 2023 showed increases of 3.1%, 4.7%, and 3.2%. While productivity growth can be unpredictable, three-quarters of consistent growth has surely contributed to this period of labor market stability with recovering levels of employee purchasing power. Reports in the Beige Book indicate that wage increases have been specifically allocated to employees who demonstrated expanding their capabilities, responsibilities, and productivity levels.

Moving forward in 2024, new hires and wage increases are expected to be moderate. Companies are challenged with navigating a fine line when increasing employee wages and projecting their labor budgets. They need to balance being conservative enough to prevent budget strain and potential layoffs, while remaining competitive and avoiding unnecessary talent turnover. In the BalancedComp Survey, turnover has been consistent at around 20% across all bank and credit union asset sizes. From the Federal Reserve Beige Book released in February of 2024, bankers reported that turnover was trending downward, primarily for frontline staff.

In a nutshell

As labor markets continue to show signs of cooling from the Pandemic and The Great Resignation, it is important to stay informed on current market conditions as most surveys are still reporting tight labor markets. The Big Stay is showing positive signs for the marketplace and economy. However, it is not fully representative of job hoppers who found a better fit. There are many factors to keep an eye on as we progress into 2024. The quit rate has gone down significantly, however, younger generations are expected to move around the labor market in the near future. This is due to their ability for continuous learning, yearning for swift career progression, and strong desire for employment opportunities that resonate with personal values. They demonstrate greater adaptability in transitioning between roles, exhibit comfort in technology-driven environments, and display a greater openness to change as they are in the early stages of their careers and lives.

Below are the national averages for 17 common positions in financial institutions.

These averages have been trended to 7/1/24. In order to tailor the midpoints to your specific market, these salaries must be multiplied by your geographical wage differential (geo%). Although this compensation methodology is the definitive way to establish an organization’s salary ranges, it does not ensure a job-ready workforce for your area of the country.

1. Teller

| Credit Unions | Banks | |

| $100-200M | $33,777.17 | $33,655.24 |

| $200-400M | $34,328.89 | $33,931.06 |

| $400-600M | $34,585.90 | $34,127.82 |

| $600M-1B | $34,825.19 | $34,361.62 |

| $1B-2B | $35,127.29 | $34,728.92 |

| $2B-4B | $35,741.24 | $35,326.50 |

2. CSR

| Credit Unions | Banks | |

| $100-200M | $36,906.70 | $36,620.35 |

| $200-400M | $38,634.11 | $37,232.98 |

| $400-600M | $38,617.73 | $37,673.57 |

| $600M-1B | $38,829.02 | $37,975.57 |

| $1B-2B | $40,045.26 | $38,845.19 |

| $2B-4B | $40,945.22 | $39,529.61 |

3. Accounting Specialist

| Credit Unions | Banks | |

| $100-200M | $43,623.25 | $44,376.41 |

| $200-400M | $44,511.29 | $45,191.13 |

| $400-600M | $45,371.23 |

$45,586.22

|

| $600M-1B | $45,750.26 | $45,747.77 |

| $1B-2B | $47,137.19 | $46,992.24 |

| $2B-4B | $47,678.80 | $46,857.69 |

4. Help Desk Specialist

| Credit Unions | Banks | |

| $100-200M | $43,930.71 | $45,895.40 |

| $200-400M | $46,367.98 | $46,788.80 |

| $400-600M | $47,758.07 | $47,672.45 |

| $600M-1B | $49,217.26 | $48,856.53 |

| $1B-2B | $51,485.99 | $49,894.19 |

| $2B-4B | $52,135.92 | $50,669.89 |

5. Trainer

| Credit Unions | Banks | |

| $100-200M | $56,223.86 | $54,929.58 |

| $200-400M | $56,424.51 | $55,425.52 |

| $400-600M | $57,385.92 | $56,217.33 |

| $600M-1B | $58,121.85 | $57,096.50 |

| $1B-2B | $58,743.14 | $58,490.96 |

| $2B-4B | $60,584.59 | $58,967.29 |

6. Consumer Loan Officer

| Credit Unions | Banks | |

| $100-200M | $53,839.47 | $54,532.23 |

| $200-400M | $54,130.34 | $56,472.82 |

| $400-600M | $56,095.55 | $56,619.01 |

| $600M-1B | $56,867.47 | $57,411.75 |

| $1B-2B | $58,520.63 | $59,445.68 |

| $2B-4B | $60,855.40 | $61,134.94 |

7. Degreed Accountant I

| Credit Unions | Banks | |

| $100-200M | $57,300.82 | $57,042.91 |

| $200-400M | $57,854.30 | $58,059.46 |

| $400-600M | $59,771.32 | $59,156.05 |

| $600M-1B | $60,058.33 | $59,894.15 |

| $1B-2B | $62,639.72 | $61,979.46 |

| $2B-4B | $64,310.99 | $62,910.10 |

8. Branch Manager I

| Credit Unions | Banks | |

| $100-200M | $62,149.35 | $61,758.73 |

| $200-400M | $64,917.44 | $62,723.72 |

| $400-600M | $65,853.63 | $65,462.17 |

| $600M-1B | $68,101.43 | $66,746.21 |

| $1B-2B | $70,514.18 | $66,703.41 |

| $2B-4B | $72,231.29 | $68,685.31 |

9. Mortgage Underwriter

| Credit Unions | Banks | |

| $100-200M | $64,863.22 | $65,368.12 |

| $200-400M | $67,712.01 | $67,353.00 |

| $400-600M | $69,827.07 | $70,549.54 |

| $600M-1B | $71,068.86 | $72,830.71 |

| $1B-2B | $73,201.63 | $73,335.02 |

| $2B-4B | $75,025.93 | $75,211.40 |

10. Financial Analyst

| Credit Unions | Banks | |

| $100-200M | $67,924.09 | $70,045.85 |

| $200-400M | $69,127.34 | $70,537.96 |

| $400-600M | $70,428.89 | $71,617.27 |

| $600M-1B | $71,112.61 | $72,153.01 |

| $1B-2B | $74,679.48 | $75,243.20 |

| $2B-4B | $77,073.94 | $76,331.88 |

11. Marketing Manager

| Credit Unions | Banks | |

| $100-200M | $75,331.67 | $72,134.97 |

| $200-400M | $78,810.23 | $74,824.88 |

| $400-600M | $83,656.53 | $78,896.77 |

| $600M-1B | $86,807.16 | $87,389.15 |

| $1B-2B | $91,953.59 | $92,016.18 |

| $2B-4B | $97,781.58 | $97,648.39 |

12. Compliance Manager

| Credit Unions | Banks | |

| $100-200M | $85,070.41 | $85,292.03 |

| $200-400M | $90,483.94 | $91,475.94 |

| $400-600M | $98,109.91 | $97,513.29 |

| $600M-1B | $100,685.45 | $101,242.03 |

| $1B-2B | $107,508.24 | $108,156.30 |

| $2B-4B | $111,863.18 | $112,939.21 |

13. VP of HR

| Credit Unions | Banks | |

| $100-200M | $109,212.74 | $109,993.76 |

| $200-400M | $120,219.15 | $127,313.54 |

| $400-600M | $136,471.59 | $135,240.92 |

| $600M-1B | $152,831.33 | $154,838.31 |

| $1B-2B | $182,787.35 | $173,146.35 |

| $2B-4B | $200,826.60 | $195,903.65 |

14. Controller

| Credit Unions | Banks | |

| $100-200M | $104,049.76 | $103,165.30 |

| $200-400M | $109,684.61 | $106,339.29 |

| $400-600M | $118,645.49 | $118,852.38 |

| $600M-1B | $125,711.62 | $123,903.55 |

| $1B-2B | $137,106.92 | $136,679.28 |

| $2B-4B | $153,464.78 | $156,800.16 |

15. IT Executive

| Credit Unions | Banks | |

| $100-200M | $120,468.27 | $122,871.28 |

| $200-400M | $150,667.91 | $141,620.00 |

| $400-600M | $159,549.27 | $156,594.10 |

| $600M-1B | $185,104.74 | $182,819.08 |

| $1B-2B | $211,659.13 | $209,642.15 |

| $2B-4B | $230,914.03 | $230,761.14 |

16. Chief Financial Officer

| Credit Unions | Banks | |

| $100-200M | $142,423.29 | $151,365.22 |

| $200-400M | $167,228.47 | $165,248.12 |

| $400-600M | $190,337.45 | $192,344.84 |

| $600M-1B | $229,364.07 | $228,142.28 |

| $1B-2B | $266,831.75 | $263,903.31 |

| $2B-4B | $310,616.91 | $313,925.97 |

17. CEO

| Credit Unions | Banks | |

| $100-200M | $210,462.77 | $239,040.64 |

| $200-400M | $275,562.54 | $281,226.62 |

| $400-600M | $326,393.17 | $321,929.49 |

| $600M-1B | $381,204.86 | $370,963.63 |

| $1B-2B | $505,181.35 | $469,893.51 |

| $2B-4B | $605,538.22 | $589,163.12 |

Data with integrity

We’re able to produce accurate, timely data and valuable insights through annual benchmarking of salary ranges. One of our most reliable sources of data comes from our reputable in-house surveys that BalancedComp conducts each year.

We invite you to participate in the new BalancedComp 2024-2025 Salary & Incentive Survey for financial institutions, open from March 25 through July 15, 2024. Participation is both free and confidential, and by participating in advance, you will receive $500 off of the final price of the survey report when it is published in September 2024.

Back to Blog