By Christie Summervill

While the pay gap is greater in the finance industry than any other, it is amendable.

Women are 20 percent more likely to leave a career in the financial industry than any other line of work.

They’re leaving because the discrepancy in pay between men and women, the pay gap, is largest in finance than any other industry. Finance positions occupy the number one position, and three others, on this 2018 report. And PayScale named financial institutions at the top of industries with the largest pay gaps.

Women represent half of the workforce in the finance industry, but only make up one-fourth of executives. Women also represent more of the lower-paying positions while men hold most of the leadership positions. It tells us something is definitely broken, and it can’t be a surprise these talented, hard-working, loyal employees are leaving not just their current job, but the industry as a whole.

This prevalent issue, especially within banks and credit unions, is something that, first, requires acceptance of the problem and, second, a concerted effort to solve and overcome it. To know if such a bias really exists and get to the root of it within your institution will require a deep audit, taking stock of your current salary structure, establishing an objective standard, and possibly even engaging a consultant.

Be beware that conducting a pay audit and then not investigating disparities and, if necessary, making pay adjustments could put employers in “the danger zone” for litigation. In some states, such as Massachusetts, a proactive pay analysis audit can be a “safe harbor” from legal action, if conducted in good faith with reasonable analysis and if reasonable progress is then made to eliminate unlawful pay disparities.

In the meantime, there are simple, affordable, actionable steps you can take to mitigate and close any gap that may be in effect at your organization.

6 Ways to Address the Pay Gap at Your Bank or Credit Union

ADVOCATE FROM THE TOP

It’s vital that top executives and leadership buy into the need to accept that a pay gap exists and create a culture and objectives to address it. If they aren’t on board, the mission is DOA before you ever realize real change. If they need to be sold on it, pay equity is just good business. Consumers and stockholders alike benefit. You can even make the case that gender diversity generates higher ROI, higher profit margins, and can even influence higher stock prices.

GRANT OWNERSHIP

Designate someone in the organization who can own this project, taskforce, or mission and hold them responsible for enforcing targets. The top HR executive would be best suited for this role, and should develop controls and put them in place through scorecard objectives and evaluation metrics.

DEVELOP A CULTURE OF FLEXIBILITY

How open to “alternative” work arrangements is your organization? This opens up the workplace to meet the personal, business, and even philanthropic goals of each employee. Where rigid 9-5, office-only positions are historically restrictive to women, this more dynamic policy opens more opportunity for qualified women to advance.

Virgin Money is a stellar example of living this goal. Jennifer Charteris, Leadership and Talent Manager, shared how their “Everyone’s Better Off” culture opened up her work arrangement to everyone’s benefit. “I have more to bring to the business from my outside interests, I can offer more to non-profits, and I get to do work I love without being away from home all week which is great for family life!”

GET RAW

When some of the biggest banks in the country published their pay gap numbers earlier this year, the validity was questioned. The reports suggest women make 99% as much as men in their organizations, based on an adjusted gap calculation. Experts argue this isn’t a true reflection of equity. The data released “is so incomplete, there’s no way for objective outsiders to assess the usefulness of these numbers,” said Mary Blair-Loy, founding director of Center for Research on Gender in the Professions at the University of California San Diego.

For a more realistic assessment, have the methodology in place to be certain of each position’s midpoint and calculate a compa ratio to demonstrate each employee’s pay level compared to the market rate. The data should be sorted by exempt, non-exempt and executive job classifications as well as by gender to absolutely demonstrate if gender bias exists. This must be the premise of any actionable corrective actions.

BE ACCOUNTABLE

Through the designated champion of the equity mission, set targets and educate all of leadership, directors, and managers on how to achieve these equity objectives. Everyone should be prepared for methodology transparency in order to affect real change and constant improvement.

CHANGE YOUR TONE

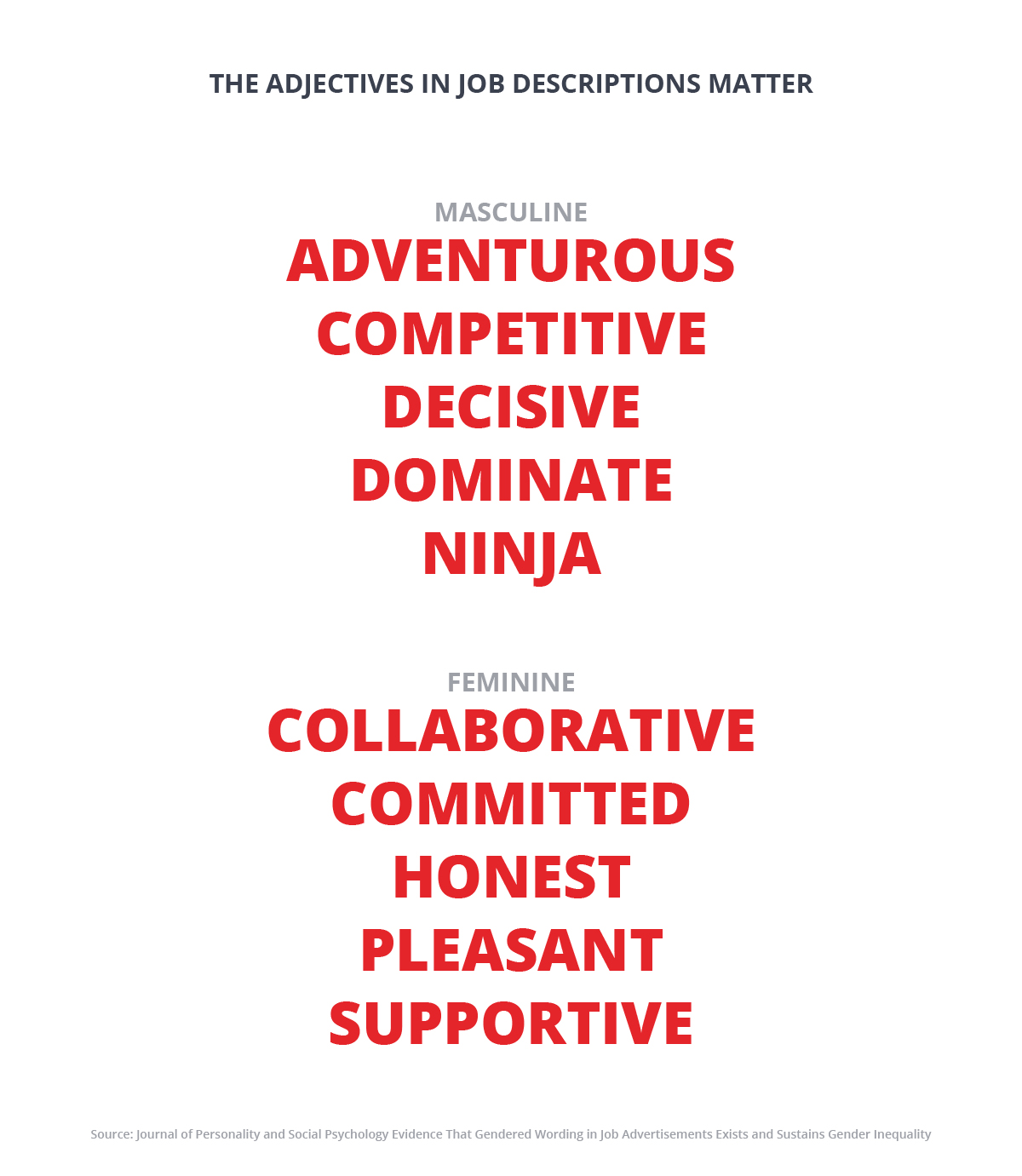

In 2011, significant research out of Duke University and the University of Waterloo identified gender bias in job descriptions. Words were coded as “masculine” or “feminine” and found to dissuade the opposite gender from applying for jobs, reducing the pool of eligible applicants. Consider an audit to revamp the language in your job descriptions to neutralize the tone; this tool could help. By standardizing the JDs away from gender, you open yourself up to even more talent and can more fairly base pay on the updated descriptions.

If half the people working in the financial industry are women, and 20 percent of those are leaving for work in other industries, their employers have as much a talent drain to address as they do pay equity concerns. This is one of the hottest hot-button issues of our time, and one that will reap benefits for those who address it in a timely, fair, and transparent manner. For banks and credit unions who are always looking for positive news to share with their customers, shareholders, and communities, a headline about equal salaries for men and women alike is information that bodes well for the organization’s bottom line, morale, and brand image.

Back to Blog